The Agenda

How small-business issues are shaping politics and policy.

In a post for our colleagues at Economix on the divide between small and big — and local and global — businesses, Nancy Folbre, an economics professor, raises a number of issues important to You’re The Boss readers.

In particular, she discusses the emergence of several groups, mostly progressive, that claim to represent local and independent small businesses. They include membership organizations like the American Independent Business Association, the Main Street Alliance, Business Alliance for Local Living Economies, as well as the Small Business Majority and the American Sustainable Business Council, which have no members.

It’s an interesting list, in an interesting column. Ms. Folbre appears to find a connection between local and liberal, painting it in opposition to global interests represented by the U.S. Chamber of Commerce. “The resulting divergence in economic interests” between local and global companies, she writes, “is driving new political alignments.”

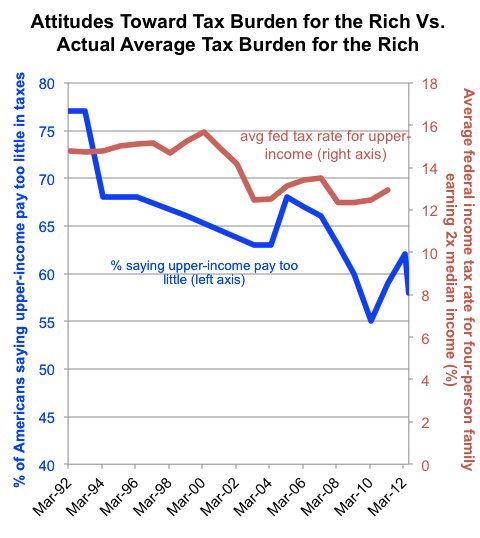

But is it? Among the issues she cites is the ability of states to collect sales taxes from online retailers that are based out of state, and in fact the Marketplace Fairness Act now seems likely to pass the Senate very soon. But Internet tax fairness, as its proponents call it, is not necessarily a battle between liberals and conservatives, although more conservatives tend to oppose it. One can support the Marketplace Fairness Act, or any number of measures intended to strengthen small, independent businesses, and still oppose, say, the Affordable Care Act or higher taxes on the wealthy. To complicate matters further, it’s not necessarily a local-versus-global issue either. Much of the backing for the Alliance for Main Street Fairness, the chief lobbying coalition for the Marketplace Fairness Act (and unrelated to the Main Street Alliance), has been supplied by national and international big-box retailers that are anathema on Main Street: Wal-Mart, Target, Best Buy and Home Depot, among others.

Perhaps the emergence of these groups simply reflects that liberal activists — and business owners — have styled themselves in a way that they hope taps into the way small businesses resonate with many Americans. As Ms. Folbre puts it, “We think of small-business owners as men and women who invest in their own communities, work in the same building as their employees, send their children to the same schools and walk their dogs in the same neighborhood parks.”

In any event, it may be a long time before these groups challenge the dominance of the conservative organizations. The groups she lists are all very small compared to the National Federation of Independent Business, which has 350,000 members, or the Chamber of Commerce, which has nearly three million small-business members, despite its often national and international orientation. (Many of those businesses — the Chamber declines to say how many — are actually members of state or local affiliates and may not necessarily buy into the Chamber’s politics. Indeed, Ms. Folbre notes that nearly 60 local chambers have withdrawn from the national organization.)

We’d like to hear from readers who have heard from some these new organizations. How did you find out about them? Did you join? Why or why not?

Article source: http://boss.blogs.nytimes.com/2013/05/06/sorting-through-the-new-political-alignments-in-small-business/?partner=rss&emc=rss