Traditionally, retirees have been told to keep a significant slice — about 50 to 60 percent of their portfolio — in these risky assets, and that’s what many people tend to do. Then they hope and pray the stock market doesn’t plummet as it did in 2008 and 2009.

That’s why the results of a new study are so intriguing. It found that holding as little as 20 percent in stocks upon retirement, with the remainder in bonds, would result in a smoother ride during turbulent markets, and the money would last a few years longer.

There is a small catch. Retirees need to gradually buy more stocks over time, but they don’t necessarily end up owning much more than most retirees start out with.

“There are a lot of retirees in serious trouble because they bailed entirely in late 2008 or early 2009 because they couldn’t get comfortable with the volatility of a traditional portfolio,” said Michael Kitces, director of research at the Pinnacle Advisory Group, who wrote the study with Wade Pfau, a professor of retirement income at The American College of Financial Services.

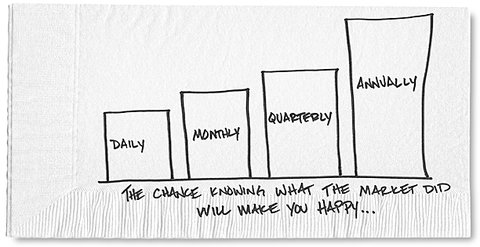

Even though it usually pays to do nothing at all when the stock market dives, it is hard to blame retirees who cannot withstand that sort of gut-wrenching volatility. So they dump their stocks at the worst possible time — either because they’re afraid or because they need the money to live on — and lock in their losses. If a smaller slice of their retirement savings were bouncing around, it might have been easier to remain invested.

The approach outlined in the study is essentially the opposite of the traditional advice, which suggests keeping a steady mix of stock and bond funds throughout retirement or slowly lowering the amount of stocks. In fact, more than half of target-date funds for people nearing or in retirement continue to reduce stock positions over time, according to Morningstar.

Portfolios that started with about 20 to 40 percent in stocks at retirement, and then gradually increased to about 50 or 60 percent, lasted longer than those with static mixes or those that shed stocks over time, according to the study. (The average target-date retirement fund for people in and near retirement holds about 48.3 percent in stocks, according to Morningstar.)

This sort of approach makes logical sense because retirees are most vulnerable in the early years of their retirement. Why? If you experience a bear market shortly after you stop working, you need to make withdrawals when the portfolio is down. You’re selling at the worst possible time.

But if the market performs poorly later, say in the second half of retirement, the damage to the portfolio is far less severe because the money had several decent years first. In other words, the sequence of your returns matters, especially in retirement. “If you have a bad sequence of returns early in retirement, you would have a lower stock allocation when you are most vulnerable to losses,” Mr. Pfau said, referring to their approach.

The second piece of this strategy involves slowly increasing your exposure to stocks. The thinking here goes something like this: If a big crash occurs in the early years after you retired, you will essentially be buying stocks when they’re cheap. So by the time the market recovers, you’ll have a bigger slice of your money in stocks again. “It becomes a ‘heads you win, tails you don’t lose,’ situation,” explained Mr. Kitces.

More specifically, the study looked at how different mixes of stocks and bonds would affect how long a retiree’s money would last if that person initially withdrew 4 percent of total assets each year (and adjusted that amount each year thereafter for inflation). So, for a person with $1 million in retirement assets, that would translate to a $40,000 withdrawal the first year; for someone with $500,000 in savings, the withdrawal would be $20,000, and so forth.

They tested the different stock and bond allocations using a Monte Carlo analysis, which simulates thousands of situations to determine the odds of possible outcomes; they also analyzed how the different mixes would perform with three different sets of market returns after inflation. (They included average historical returns and today’s nonexistent bond yields and a 3.1 percent return for stocks, on average. The third set of returns assumed bonds generated 1.5 percent while stocks produced 3.4 percent.)

Even in a worst case, they found that new retirees who start with 30 percent in stocks and slowly increase that allocation by 1 percentage point a year to 60 or 70 percent in stocks would be able to withdraw 4 percent of their portfolio for about 30 years. Someone who held 60 percent in stocks and 40 percent in bonds over 30 years would run out of money two years earlier, but would also have to endure a bumpier ride, the researchers said. (These results assumes stocks will grow about 6.5 percent a year, on average and after inflation, while bonds will increase 2.4 percent).

Article source: http://www.nytimes.com/2013/09/14/your-money/turning-the-conventional-stock-buying-wisdom-for-retirees-on-its-head.html?partner=rss&emc=rss