Carl Richards is a certified financial planner in Park City, Utah, and is the director of investor education at The BAM Alliance. His book, “The Behavior Gap,” was published this year. His sketches are archived on the Bucks blog.

Just when I thought investors had figured out to behave, I took a look at some of the recent barometers of investor sentiment. And it led me to ask, “Are we really going to do this again?”

“This,” if you’re wondering, requires looking back to 2009. Remember how you felt? Remember being so scared that you couldn’t get out of stocks fast enough? I remember. In fact, I remember that many of us swore that we would never, ever invest in stocks again. But some of the previously burned have apparently been reconverted.

For instance, let’s take a look at the Consensus Index which, as of June 3, reported that 73 percent of investors are feeling “bullish.” Other measures have similarly shown positive feelings about the market (although the AAII Index reading isn’t quite as upbeat).

Stop and think about this change in attitude for a minute. Both the Standard Poor’s 500 Index and the Dow have already gained more than 120 percent since March 2009, and the vast majority of investors are feeling “bullish” about the stock market.

Doesn’t this sound familiar?

Before you accuse me of being being all gloom and doom about the market, remember that I haven’t said anything about what I think the market will do. In fact, I have no idea what the market will do in the future. I am, however, nearly positive that I know what these excited investors are going to do.

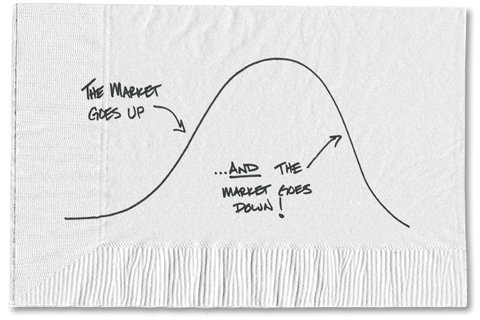

By and large, these investors are investing based on emotion — my neighbor is in the market, I have to be in the market, too. But they’re only setting themselves up to repeat the mistakes of the market meltdown in 2008-2009. That’s because at some point (and this doesn’t require a crystal ball) the market is probably going to drop again. So investors who jumps back into the market today are likely to find themselves repeating that same pattern of buying high (now) and selling low (at some point in the future).

To be clear, I am not saying we should get out of the market. I am not saying we can time the market. I am saying that the idea of people feeling “bullish” worries me, especially when I see headlines like this in “USA Today“: “Bull run gets solid footing.”

So if you’ve decided that now is the time to increase your allocation to stocks, please take the necessary steps to avoid eventually selling out of fear once again:

1. Remember how you felt in March 2009.

Perhaps you have a reminder somewhere of how you felt in March 2009. Maybe it’s little note in a journal, or a blog post, that will help you recall that feeling of dread that caused you to sell. If you can’t find a reminder, talk to your spouse, your accountant, your financial adviser or anyone who could remind you of that moment. Try to bring those feelings back for a minute so you can avoid making the same mistake again.

2. Make sure you have a plan.

To be clear, my advice today isn’t about whether it’s a good or bad idea to invest in stocks. But it is foolish to invest without a plan, regardless of where the markets stand. So make sure you have a plan based on your goals. Pay attention to investment fees. Make sure you’re diversified. Then do your best to ignore your investments. For the average investor, that’s really the only way I know to keep your sanity.

3. Figure out how you’re going to avoid quitting next time.

Yes, there will be a next time. At some point, just like the best roller coasters, the market will take a drop, and they don’t ring a bell before it happens. So make sure you’re prepared for that moment. Have you placed some emotional guardrails in place to avoid going over the edge? You will want to sell, but unless it’s a part of a planned rebalancing, you can’t afford to let emotion drive you from the market again.

Ultimately, these investor sentiment surveys aren’t telling us anything we don’t already know. Average investors tend to get really excited about the market when things are going well. But the idea that we’re about to repeat the same cycle we just survived is ridiculous. You owe it to yourself to figure out a plan that gets you through both the ups and the downs of the market.

We know better. We should act like it.

Article source: http://bucks.blogs.nytimes.com/2013/06/04/avoiding-the-easy-trap-of-buying-high/?partner=rss&emc=rss