But to the administration’s surprise, a new competition to build the helicopters much more cheaply is also running into trouble. Industry officials said that only one company, Sikorsky Aircraft, was likely to bid on the multibillion-dollar contract this week. And some of Sikorsky’s rivals are voicing an increasingly common complaint — that bid specifications are being written so narrowly they are driving away potential competitors.

Given the budget crisis, the White House has reiterated the call for sharper competition in all areas of contracting, to lower costs. But the bidding for Marine One, the helicopter that sweeps away presidents from the White House lawn, suggests that goal is hard to achieve, as have other recent contract troubles. By putting more emphasis on price and being more precise in what it wants, the government could end up with cheaper bids, but could also be excluding equipment that might be more flexible or less expensive in the long run, experts in government contracting said.

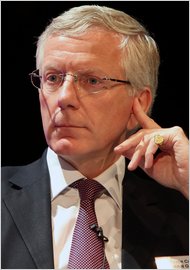

“The question is not whether the president can get the cheapest helicopter, but the best one that’s affordable to buy,” said Jacques S. Gansler, who was the top Pentagon acquisition official in the Clinton administration. “It’s like when you buy a car. Do you drive a Yugo? Or is the best buy the cheapest one that meets your needs?”

Such questions have simmered for months among military and information-technology companies, which are feeling the pinch as opportunities to win large federal contracts dwindle. But the issues could attract wider attention now that the president’s own helicopter is back in the spotlight.

Mr. Obama first expressed concerns about the cost of the new helicopters shortly after he took office in 2009, when Senator John McCain of Arizona, who had been his Republican opponent in the presidential race, confronted him at a conference on fiscal responsibility. At the time, the projected price for 28 futuristic helicopters, to be designed to fend off terrorist attacks and resist the electromagnetic effects of a nuclear blast, had nearly doubled, to $13 billion.

Mr. Obama responded by saying that the existing fleet of white-topped helicopters, which are now 35 to 40 years old, seemed “perfectly adequate to me.” He also promised to fix the procurement process.

Since then, the White House Military Office, which sets the requirements for the helicopters, and the Navy, which buys them because the Marines fly them, pared back some of the demands that had contributed to the cost overruns, like how fast the helicopters must fly and how far they can go without refueling. The Navy also decided that it would supply the sensitive communications gear using existing technology rather than asking the contractors to create something new.

The latest plan is to buy 21 helicopters — at a much lower but unspecified cost — that would begin to enter service in 2020. Congressional auditors have praised the plan as more sensible, and the Navy had said it expected “a full and open competition.”

But with the bids due on Thursday, officials at three companies that had considered bidding — Boeing, Bell Helicopter and Europe’s AgustaWestland — all said in interviews that they had decided not to.

AgustaWestland, which was expected to be Sikorsky’s biggest rival, said in a statement that several aspects of the bid process “inhibit our ability to submit a competitive offering” and “provide a significant advantage to our likely competitor.”

Under the deal that the Obama administration scrapped, AgustaWestland had supplied the helicopters to Lockheed Martin, the prime contractor. (The Navy later sold the nine basic helicopters they produced to Canada for $164 million to use for spare parts.) AgustaWestland teamed with Northrop Grumman in preparing for the new competition, while Lockheed Martin is now working for Sikorsky.

Article source: http://www.nytimes.com/2013/07/29/business/few-suitors-to-build-a-new-marine-one.html?partner=rss&emc=rss