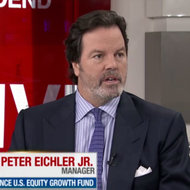

Business News NetworkPeter J. Eichler Jr., chief executive of Aletheia Research and Management.

Business News NetworkPeter J. Eichler Jr., chief executive of Aletheia Research and Management.

Federal regulators are preparing a civil fraud case against a prominent Los Angeles money manager, a government lawyer said at a court hearing on Wednesday.

The manager, Peter J. Eichler Jr., chief executive of Aletheia Research and Management, has received a so-called Wells notice from the Securities and Exchange Commission, an indication that the agency is considering an enforcement action.

Gary Leung, an S.E.C. staff lawyer, disclosed the potential lawsuit during a hearing in United States Bankruptcy Court in Los Angeles. Aletheia filed for bankruptcy protection on Nov. 11, and owes as much as $50 million.

A bankruptcy lawyer for Aletheia, Brian Davidoff, said that his client disputed the S.E.C.’s possible claims. A Wells notice typically gives the recipient a chance to dissuade the S.E.C. from proceeding with its case.

Regulators are said to be looking into accusations of improper trading, including whether client accounts were manipulated through the late allocation of trades. It is also examining whether money-losing trades were shifted from client accounts into Aletheia’s accounts, said a person briefed on the case who spoke on condition of anonymity.

The Justice Department has also taken an interest in Aletheia’s bankruptcy case. On Monday, prosecutors in the tax division of the United States attorney’s office in Los Angeles made a request with the bankruptcy court that it be notified of all pleadings filed in the case.

The S.E.C.’s warning is the latest setback for Mr. Eichler, who until recently was a highly regarded money manager. At its peak, Aletheia managed nearly $10 billion in assets and had a superior long-term investment track record that handily outperformed the Standard Poor’s 500-stock index. The firm’s flagship growth strategy attracted business from Goldman Sachs and Morgan Stanley, which both invested their clients’ money in Aletheia funds. Both banks have terminated their relationships with Aletheia.

Aletheia also drew attention for its involvement in several prominent shareholder fights, including when it teamed up with the billionaire investor Ronald Burkle to wage a proxy battle with the bookseller Barnes Noble.

Named after the Greek word for “truth and disclosure,” Aletheia was started in 1997 by Mr. Eichler, a former executive at Bear Stearns. He operated the firm out of wood-paneled headquarters at 100 Wilshire Boulevard in Santa Monica, a prestigious office building with commanding views of the Pacific Ocean.

But Mr. Eichler and Aletheia have been under a cloud since 2010, when a senior executive at the firm, Roger B. Peikin, filed an explosive wrongful-termination lawsuit. He depicted Mr. Eichler as a tyrannical boss who ruled Aletheia “with an iron fist” and operated the firm as his “personal fiefdom.” The complaint also accused Mr. Eichler of misconduct related to “general disregard for regulatory controls, wanton expenditure of corporate assets for Eichler’s personal benefit, and overall neglect of the business side of Aletheia’s operations.”

Aletheia has had mounting legal problems in recent years. It already had a dispute with the S.E.C. when, in 2011, it paid the agency $400,000 to settle civil charges related to deficient record-keeping.

The firm is also engaged in a legal fight with Proctor Investment Managers, a private equity firm based in New York, over the terms of a deal in which Proctor took a 10 percent stake in Aletheia.

Despite its legal woes and tepid performance across its funds, Aletheia still managed about $1.4 billion as of Sept. 30, according to securities filings.

A version of this article appeared in print on 11/22/2012, on page B5 of the NewYork edition with the headline: S.E.C. Weighs Suing Aletheia Manager.

Article source: http://dealbook.nytimes.com/2012/11/21/s-e-c-weighs-suing-aletheia-manager/?partner=rss&emc=rss