The decline was not large — 24,000 jobs, or 0.1 percent of the 19.3 million people out of work in May. But it was the first month in more than two years that there had been a decline.

Some, but not all, of that decline was in Germany, where unemployment has been falling even as it rose in other countries. Other euro zone countries that reported declines during the month were Austria, Finland, Ireland, Italy, Portugal, Slovenia and Spain. Two of the 17 countries in the zone, Estonia and Greece, have yet to report.

The accompanying charts show how the number of people unemployed has risen or fallen since March 2008, the month that overall unemployment in the euro zone hit its recent low. The charts also show the trends in two major countries outside the zone, Britain and the United States, where unemployment had bottomed out earlier. In the United States, the low was reached in October 2006, more than a year before the recession officially began.

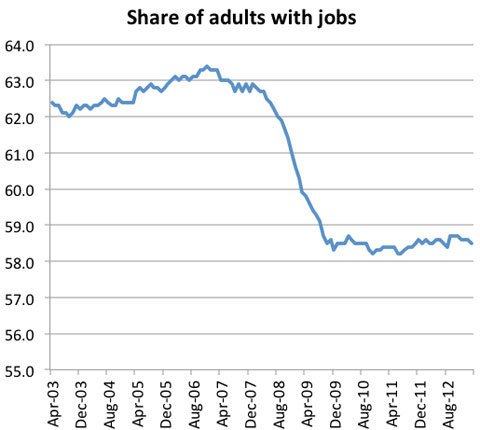

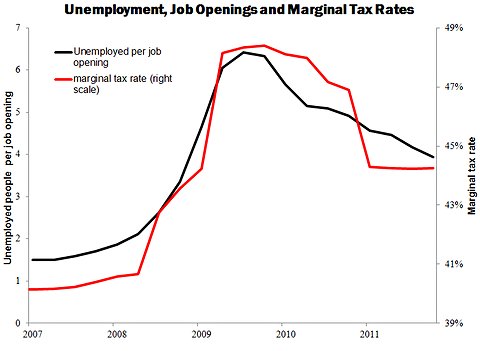

It should be noted that the number of unemployed workers does not exactly equate to the number of people without jobs, which may be changing at a faster or slower rate. Discouraged workers who conclude they cannot get a job can drop out of the labor force, and thus not be counted. But when things begin to improve, those people can begin to search for employment and be newly counted among the unemployed.

Perhaps the most striking thing about the charts is how little improvement there has been in most of the countries shown. Germany is the striking exception to that, of course, and the number of unemployed in the United States has been falling steadily, if slowly, since 2010. On Friday, the government reported that the American unemployment rate fell to 7.4 percent in July, the lowest since December 2008. The number of people out of work in Britain fell in 2012 but has stabilized in recent months.

Among the most troubled countries in the euro zone, only in Ireland has there been a significant decline in the number of unemployed workers, although the figure remains nearly one and a half times as high as it was in 2008. In Greece, the number out of work appeared to stabilize late last year, but it began to rise again this year and was at the highest level yet in April, the last month for which data was available.

Perhaps the most extraordinary development has been in the Netherlands, where the number of unemployed workers has begun to rise rapidly after rising relatively slowly early in the credit crisis. Nonetheless, the latest unemployment rate for the Netherlands is only 6.8 percent, a figure that is lower than that of either the United States or Britain and about half the rate in Ireland.

For some countries, the reported unemployment rates remain very high. Although the number of unemployed workers in Portugal was reported to have fallen in both May and June, the unemployment rate remains at 17.4 percent, not far below the high of 17.8 percent reached in April. In neighboring Spain, two months of falling unemployment have reduced the rate by only 0.2 percentage points, to 26.3 percent. At least Spain no longer ranks as having the highest unemployment rate in the euro zone, as it did at the end of 2012. Greece, at 26.9 percent at last report, has regained that unfortunate position.

Floyd Norris comments on finance and the economy at nytimes.com/economix.

Article source: http://www.nytimes.com/2013/08/03/business/economy/in-europe-too-a-painfully-slow-jobs-recovery.html?partner=rss&emc=rss