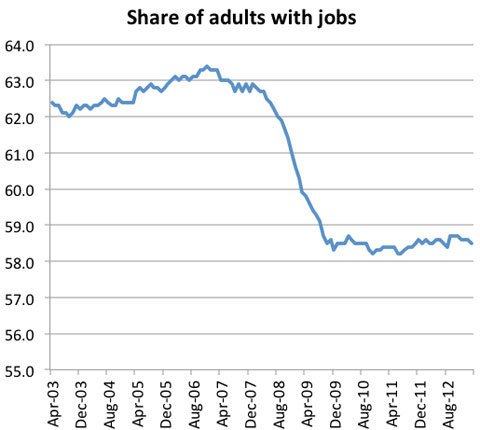

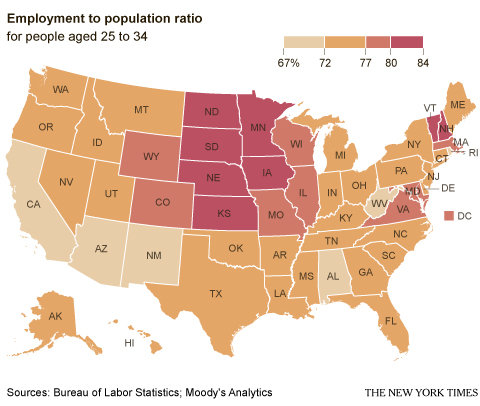

In three regions – the upper Midwest, New England and the area around Washington – the job market for younger adults is considerably stronger than in the rest of the country. These three regions are the closest thing to an exception to the trend I described in a Sunday column: the sharp decline in employment rates for adults 25 to 34 years old. Whereas the United States had perhaps the highest employment rate for this age group among large, wealthy economies in 2012, it has one of the lowest today.

When you look at the three regions that are doing better, you quickly notice they are among the country’s best educated. According to the Census Bureau, the 10 states with the greatest share of bachelor’s degree holders are, in descending order: Massachusetts, Colorado. Maryland, Connecticut, New Jersey, Virginia, Vermont, New York, New Hampshire and Minnesota. And the District of Columbia has a higher share than any state does. Many of those also have relatively high employment rates for people 25 to 34.

The state with the lowest share of bachelor’s degree holders is West Virginia, which also has the lowest share of employed 25- to 34-year-olds. Only 67.1 percent of West Virginians in that age group were employed, based on the most recent data, from 2012. The next nine states from the bottom of the bachelor-degree ranking don’t have high employment rates, either: Arkansas, Mississippi, Kentucky, Louisiana, Nevada, Alabama, Indiana, Oklahoma and Tennessee.

This pattern is especially striking because the employment measure here — the employment-population ratio – counts as non-employed everyone who does not have a job, including people in graduate school. No employment metric is perfect. I used this one because I wanted to capture people who would prefer to be working but who are not officially unemployed — that is, actively looking for work. (For more on the flaws with the official unemployment rate, listen to Stephen Colbert.)

States with a relatively high proportion of college graduates are also states where a larger number of people in their late 20s are likely to be enrolled in graduate school and thus not working. Yet these states are nonetheless the one with some of the highest employment rates.

To be clear, education is not the only explanation. Workers in the Washington metropolitan area benefit from the federal government, and parts of the Midwest can thank an energy boom. North Dakota has the highest share – 84 percent – of 25- to 34-year-olds who are employed.

The state data here comes from Moody’s Analytics, based on underlying numbers from the Bureau of Labor Statistics, and my colleague Alicia Parlapiano created the map. Sometime soon, we will look at employment rates by metropolitan area.

Article source: http://economix.blogs.nytimes.com/2013/05/06/where-the-jobs-for-the-young-are-and-arent/?partner=rss&emc=rss