Carl Richards

Carl Richards

Carl Richards is a certified financial planner in Park City, Utah, and is the director of investor education at the BAM Alliance. His book, “The Behavior Gap,” was published this year. His sketches are archived on the Bucks blog.

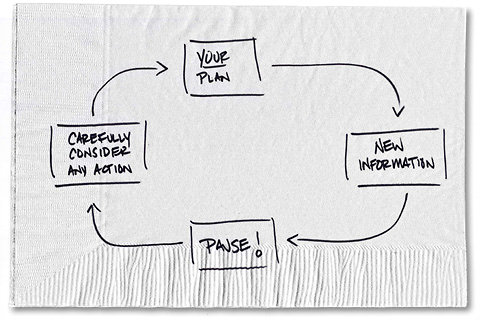

New information is scary. When things change, we often don’t know what to do. We may have had a plan before things changed, but things are different. So now what?

With the election last week, we suddenly have lots of new information, or at least it feels like we do. A little less than half the country is surprised and even disappointed. And unless you’re living in a cave, you’re now hearing about the uncertainty surrounding the looming budget showdown.

At times like these, there is a tendency to act now and ask questions later. Before you do, take just a moment, a small pause, and walk through a few steps to avoid making a big mistake.

1. Do you have a plan?

I’m assuming you do. You have a clear idea of where you are today, where you want to go and you have spelled out the investment process that you think will get you there.

2. Does this new information change that plan?

Any investment or financial plan most likely has risk built into it. Uncertainty is not new. Of course, this time might indeed be different, but don’t bet on it. Instead, make sure that the level of risk you’re taking matches your goals.

3. Should you change course?

After reviewing your plan in light of this new information, the key question to ask is whether a change is warranted. The primary reason for making changes to a sound plan depends on changes in your life and goals, not changes in the markets or politics. So if your goals haven’t changed, and you have a rational plan to get there, stick with it.

If, on the other hand, this new information has you reassessing your goals and the level of risk required to get there, it might be time to revisit your plan. Do it deliberately and with care, because history has shown that selling when worried can be a bad idea.

And all this process requires is that you pause and ask a few questions before acting. It seems like a small thing to do to avoid making the same painful mistakes over and over again.

Article source: http://bucks.blogs.nytimes.com/2012/11/12/an-election-probably-shouldnt-change-your-financial-plan/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.