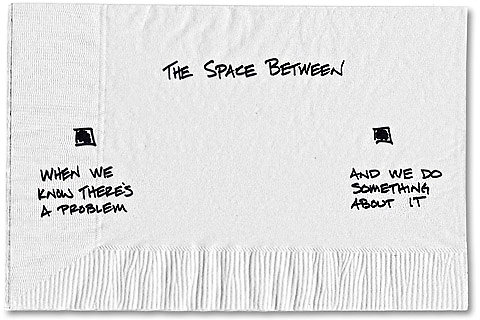

Fundamentally

Investing Abroad This Year? Remember a Good Map

By PAUL J. LIM

Stock investors have already picked much of the low-hanging fruit in foreign markets, leaving some of the stocks overpriced, advisers say.

Article source: http://www.nytimes.com/pages/business/mutfund/index.html?partner=rss&emc=rss