Carl Richards

Carl Richards

Carl Richards is a certified financial planner in Park City, Utah. His new book, “The Behavior Gap,” was published earlier this month. His sketches are archived here on the Bucks blog.

Avoiding Painful Financial Decisions

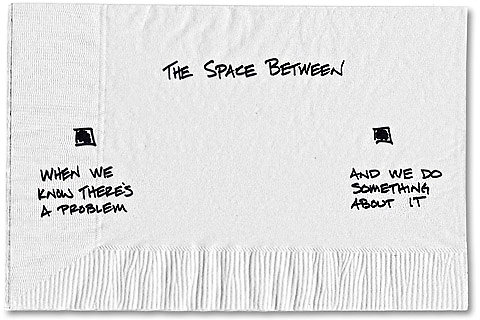

Recently I’ve had a lot of conversations with people about why we avoid facing painful financial decisions. These conversations have got me thinking about the time between the first sign of trouble and the moment when we finally decide to face reality.

Sometimes that space needs to be long — we need time to sort out all the options or maybe we just need to be patient and wait for a new path to open. But most of the time we’re just delaying the inevitable.

So why do we take so long to act?

Being wrong isn’t fun. When there’s a problem, it’s often because we’ve made a mistake. We’ve been conditioned to believe that making a mistake is something shameful. Embarrassed, we tell ourselves stories to avoid recognizing that we’re in trouble. We tell ourselves that things aren’t actually that bad. We tell ourselves that things will get better. We even look for others to blame.

No one likes losing. For most of us, the pleasure we get from gain, like our investments doing well, is dwarfed by the pain we feel from loss. While this pain can be chronic from a continuing issue, it becomes acute when we decide to face the facts and do something about it.

Think about the last individual stock you bought that went down after you bought it. You didn’t do much research, and on an intellectual level, you knew that buying individual stocks without any more research than your brother-in-law’s suggestion was a bad idea. You knew that you should sell it and move on.

The pain is there, like a low-grade headache. Then one day, you decide to do something about it. And the process of actually facing the fact that you just realized a loss by selling represents finally admitting that you were wrong. Now you might even have to explain it to your spouse or, even worse, your accountant. That is painful!

We’re busy. Often we know we need to make a change, but we just put it off because we tell ourselves we’re too busy to “research” it right now. We’re all busy, and I don’t know very many people that put facing their current financial reality very high on their list of things to do next weekend. And of course, we tell ourselves that we need a lot of time to research all our options, which might be true.

But big mistakes almost always start as small mistakes. Then we delay doing something about them, and they grow until we find ourselves in a hole that we thought unimaginable just a short time before.

You’ve probably heard the old saying that your first loss is the best loss. I’m not sure who said it first, but I did see that Jim Cramer has it as commandment number two, which means something. Based on my experience this is true. When things go wrong, it is often best to act quickly and move on.

So when you realize that you’ve made a mistake, think about the space between the mistake and the solution. Decide if this is one of the rare mistakes that take time, or the more common that ought to inspire immediate action. If it is the latter, it’s time to stop making excuses and to start seeking solutions.

The tough decisions won’t go away on their own, and like compound interest, the size of our problems will only grow over time. Ultimately, we’re only doing ourselves a favor by shortening the space between when we know we made a mistake and when we finally decide to do something about it.

Article source: http://feeds.nytimes.com/click.phdo?i=dbfa79b92c6baa445a8b5dede2cb6879

Speak Your Mind

You must be logged in to post a comment.