Bruce Bartlett held senior policy roles in the Reagan and George H.W. Bush administrations and served on the staffs of Representatives Jack Kemp and Ron Paul. He is the author of “The Benefit and the Burden: Tax Reform – Why We Need It and What It Will Take.”

Last week, the investor David Einhorn sued Apple, in which his hedge fund is a large shareholder, to prevent it from taking actions that would allow it to continue holding onto its $137 billion in cash, rather than paying it out as dividends.

Today’s Economist

Perspectives from expert contributors.

Mr. Einhorn’s action highlights a growing problem: many corporations are holding vast amounts of cash and other liquid assets, using them neither for investment nor to benefit shareholders. These assets are largely earned and held overseas, and not subject to American taxes until the money is brought home.

Such tax-avoidance techniques, while legal, have come under increasing political attack. On Thursday, Senator Bernie Sanders of Vermont introduced legislation to end deferral and force multinational companies to pay taxes on their foreign-source income.

According to the Federal Reserve, as of the third quarter of 2012 nonfinancial corporations in the United States held $1.7 trillion of liquid assets – cash and securities that could easily be converted to cash.

By any measure, corporate cash holdings appear to be high and rising.

According to the Federal Reserve, nonfinancial corporations historically held liquid assets of 25 to 30 percent of their short-term liabilities. But this percentage began rising in 2001 and now tends to be in the 45 to 50 percent range. In the third quarter of 2012, it was 44.9 percent.

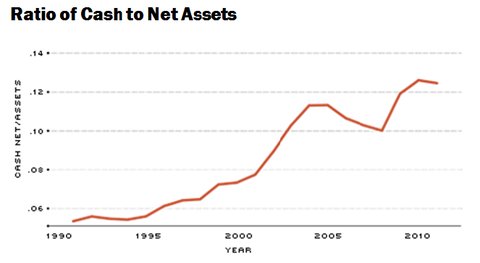

A recent study by Juan Sánchez and Emircan Yurdagul of the Federal Reserve Bank of St. Louis looked at the ratio of cash to assets at all publicly held nonfinancial, non-utility corporations. They found that, historically, such corporations held cash equal to about 6 percent of their assets, but that began rising in 1995 and is now more than 12 percent, as seen below.

Federal Reserve Bank of St. Louis analysis of Compustat data

Federal Reserve Bank of St. Louis analysis of Compustat data

One obvious explanation for higher cash holdings by corporations is the uncertainty of the economic environment in the aftermath of the financial crisis. They may also face greater difficulty in getting credit on short notice and need to hold more cash as a precaution.

Another explanation, put forward by the economists Thomas W. Bates, Kathleen M. Kahle and René M. Stulz, is that the growing research-and-development intensity of corporations forces them to hold more cash than they used to. They also note that companies hold fewer inventories and accounts receivable than they used to. And, they say, these factors make corporate cash flow less dependable than previously, thus necessitating the need for higher cash holdings.

A 2011 study by the International Monetary Fund (see Pages 44-49) suggests that higher cash holdings by corporations are simply a sign that they plan new investments in the near future. It says this is a “good omen,” which indicates that “investment could increase substantially over the next year or two.”

However, the dominant explanation for the increased liquidity of nonfinancial corporations appears to be the growing role of multinational corporations and the profits of their foreign operations.

In a 2006 speech, the Federal Reserve Board governor Kevin Warsh noted that higher corporate cash holdings were dominated by those with foreign operations. Between 2001 and 2004, the ratio of cash to assets at domestic-only corporations increased 20 percent, while it increased 50 percent among multinational corporations.

While this may indicate that multinational corporations expect better growth potential among their foreign subsidiaries and plan additional offshore investments, a more likely explanation is tax-based.

Under American tax law, corporate profits generated offshore are taxable, with a tax credit for taxes paid in foreign jurisdictions. But American taxes don’t apply unless and until such profits are repatriated to the United States. Thus, as long as profits are held abroad, United States taxes are deferred indefinitely.

A 2007 study in the Journal of Financial Economics found that among multinational corporations, those facing higher repatriation taxes tended to hold more cash abroad than those facing lower tax burdens. Moreover, cash holdings tend to be higher in countries with low taxes than those with high taxes. Tax sensitivity appears to be more pronounced among technology-based companies.

More recent research published by the National Bureau of Economic Research tested for the impact of taxes on corporate cash holdings by looking at companies that become multinational. They do not tend to increase their cash holdings afterward, thus undermining the tax-based explanation. But the study also finds that research and development intensity is a crucial factor.

The major role of R.D. in large cash holdings may reflect the greater opportunities for tax avoidance among businesses that can easily transfer intangible property abroad without having to move production operations or jobs to other countries. It is a simple matter for companies holding patents, copyrights or trademarks to transfer them to foreign subsidiaries and realize the profits accruing to them in lower-taxed jurisdictions.

I had an experience with this phenomenon just recently. I needed a copy of Microsoft Word for a new computer and went to www.microsoft.com to buy it. But when I tried to pay for it, my credit card was rejected. When I checked with my credit-card company I was told that the charge appeared suspicious because it went to a company based in Luxembourg – a well-known tax haven.

This technique is used by many technology-based companies. For example, The Wall Street Journal reported on Feb. 7 that the patent for the hepatitis C medication produced by California-based Gilead Sciences is domiciled in Ireland, another common tax haven. The home company thus pays royalties to its Irish subsidiary on sales of the drug in the United States, transferring profits from the United States to Ireland.

While the prospects for individual income tax reform appear to be fading, those for corporate tax reform are more positive. The problem of deferral

and the large amount of cash held abroad by multinational corporations based in the United States are key factors driving both parties toward action, possibly this year.

Article source: http://economix.blogs.nytimes.com/2013/02/12/the-growing-corporate-cash-hoard/?partner=rss&emc=rss