No one has tried that — at least not yet — but one small airline has led the way in the United States when it comes to passenger fees: Spirit Airlines, the no-frills carrier that prides itself for offering the lowest fares, then charging passengers for everything else.

Need an agent to print out a boarding pass at the airport? That’s $10. Want some water? That’s $3. Rolling a bag on board? The tag costs $35 from home and $50 at the airport. In all, there are about 70 fees enumerated in dizzying detail on Spirit’s Web site for customers to navigate.

To the millions of travelers flying on vacation this summer, the fees can be infuriating, but Spirit makes no apologies. In an age of consolidation in the airline industry, Spirit, with about 1 percent of the nation’s passenger traffic, has managed to succeed by going it alone, scraping for every dollar and scrimping on every cost.

“Spirit does everything it can to make or save a buck,” said Henry Harteveldt, a travel analyst with Hudson Crossing. “To its credit, Spirit doesn’t promise passengers that they’ll be coddled. Its customer service standards are terrible, and the airline’s actions have shown it doesn’t care about being liked or respected.”

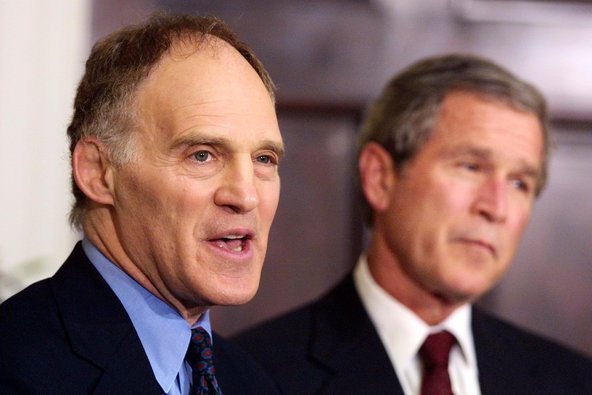

The driving force behind that strategy is Spirit’s chief executive, Ben Baldanza, 51, an industry veteran who arrived at Spirit eight years ago with no experience at a no-frills airline. Along with an obsessive attention to keeping costs low, Mr. Baldanza argues that the cornucopia of fees allows the airline to keep its fares lower than rivals. The airline, known for its tasteless ads (during the presidential election, one ad talked of Spirit having “binders full of sales. Women will love them!”) is modeled after Ryanair, which charges low fares for flights throughout Europe with a minimalist approach to customer service.

“I cringe a little when people say I don’t care about customers,” said Mr. Baldanza, who brims with missionary zeal. “We care about the thing that customers tell us they care the most about, and that’s offering the lowest possible fares. The customers who fly Spirit absolutely understand the trade-off.”

On a recent day at La Guardia Airport, passengers seemed to be taking the fees in stride. Two students forgot about the fee that Spirit charges for carry-on bags. That did little to reduce their enthusiasm to fly to Las Vegas despite the early loss. Kevin Reed, a photographer flying to Myrtle Beach, S.C., paid an extra $10 on top of a $35 checked-bag fee because he failed to do so when he bought his ticket.

“They got me there,” he said, shrugging. “But I’m still saving $400 over flying with Delta.”

Not every customer has the same reaction, though. Spirit is routinely rated as the nation’s worst airline because some travelers deem the fees unfair. The Transportation Department receives far more complaints about Spirit than other carriers, with 6 to 8 complaints per 100,000 passengers compared with the industry average of 1.4. And Spirit’s on-time record is similarly abysmal, at 68.8 percent compared with 80 percent for the industry average. The best airlines are in the mid-90s.

Critics point out that the inflation of air travel fees makes it increasingly difficult to compare the cost of travel between airlines.

“The fee-for-everything technique allows airfares to be advertised as much lower than the overall cost,” said Paul Hudson, the president of FlyersRights.org, a consumer group.

Mr. Baldanza acknowledged that the process can be tricky. “You can’t sleepwalk through the process,” he said.

But the model has allowed Spirit to offer cheap tickets. Since 2008, Spirit’s airfare has dropped by 20 percent, averaging $75 in 2012 compared with $94 in 2008. The difference often jumps out at a customer searching for flights. On Friday, Spirit was offering a nonstop flight from Oakland, Calif., to Portland, Ore., in mid-July for $156; the same trip was $296 on Delta.

Because of its growing list of fees, however, nonticket revenues grew to $51.39 in 2012, from $18.61 in 2008. As a result, while fares fell, Spirit’s total revenue per passenger grew by 12 percent from 2008 to 2012, reaching $126.50. Fees now account for 41 percent of Spirit’s revenues, an industry record.

Article source: http://www.nytimes.com/2013/06/01/business/spirit-airlines-banks-on-few-frills-and-more-fees.html?partner=rss&emc=rss