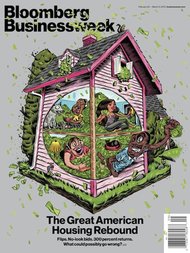

A Bloomberg Businessweek magazine cover published Feb. 25 about the housing rebound in the United States — featuring cartoonish minorities holding fistfuls of money — has drawn intense criticism from readers and media critics, some of whom have described the cover as racist.

The Feb. 25 issue of Bloomberg Businessweek. Enlarge Image »

The Feb. 25 issue of Bloomberg Businessweek. Enlarge Image »

“Our cover illustration last week got strong reactions, which we regret,” Josh Tyrangiel, the magazine’s editor, said in a statement on Thursday. “Our intention was not to incite or offend. If we had to do it over again we’d do it differently.”

But his statement came too late to head off pointed criticism online. Some posts on Twitter called it a “non-apology,” and by Thursday afternoon, a handful of people had signed an online petition urging the company to pull the cover. (A new issue, however, is already on newsstands.)

Matthew Yglesias, a business correspondent at Slate, prompted much of the online commentary after questioning the cover in a post on the Web site Thursday morning. While praising the publication for being “a genuinely great magazine that does an amazing job of making business and economics news accessible and interesting,” he said Bloomberg Businessweek “ought to be ashamed” for its cover choice.

Ryan Chittum, at the Columbia Journalism Review, said the cover was “clearly a mistake” because of “its cast of black and Hispanic caricatures with exaggerated features reminiscent of early 20th-century race cartoons.” What made it even more offensive, Mr. Chittum wrote, “is the fact that race has been a key backdrop to the subprime crisis.”

In a statement, Andres Guzman, the illustrator who created the cover, said, “The assignment was an illustration about housing. I simply drew the family like that because those are the kind of families I know. I am Latino and grew up around plenty of mixed families.” According to Mr. Guzman’s Tumblr page, he was born in Lima, Peru and lives in Minneapolis.

In an interview, Hugo Balta, the president of the National Association of Hispanic Journalists, said the cover “continues to speak to the insensitivity of how minorities, and in this case Latinos, are being portrayed in media.”

“I think it oversimplifies an issue that obviously has tremendous financial impact to the country, and it also puts a face to a community that is too often vulnerable to those types of attacks,” Mr. Balta said. “If we go with the old saying that a picture is worth a thousands words, the message in this picture is that it’s the minority’s fault.”

Mr. Balta said he planned to contact Bloomberg Businessweek to discuss the issue.

Gregory Lee Jr., the president of the National Association of Black Journalists, said in a statement, “The image that was published by Bloomberg Businessweek is just a microcosm of a bigger problem in the magazine industry — the lack of diversity.”

“The last presidential election demonstrated that our nation’s demographics are changing rapidly and it is essential that media companies should make the appropriate changes to welcome diversity in their newsrooms, specifically in managerial positions,” Mr. Lee said.

Article source: http://mediadecoder.blogs.nytimes.com/2013/02/28/magazine-cover-draws-claims-of-racism/?partner=rss&emc=rss