Casey B. Mulligan is an economics professor at the University of Chicago.

A possible compromise between Democrats who want to leave the unemployment compensation system unchanged and Republicans who want to return to pre-recession benefit formulas might be to adopt a benefit formula from some of the previous recessions.

Today’s Economist

Perspectives from expert contributors.

At the end of 2011, Congress allowed unemployment beneficiaries to continue to collect under both the emergency and extended programs, which permit the unemployed to receive benefits for up to 99 weeks of unemployment.

Some economists believe that unemployment insurance stimulates spending because unemployed people are thought to spend most, if not all, of the money they have on hand. Some economists also suggest that unemployment insurance prolongs unemployment because an unemployed person has to give up his benefits as soon as he finds and starts a new job or returns to working at his previous job. Either way, some people cannot find work, and unemployment benefits help cushion their blow.

The ideal amount of time to permit the unemployed to collect benefits is a trade-off between the insurance the program provides and the unintended work disincentives it creates. For now, our government has decided that 99 weeks is the ideal time (92 in many states, and a bit less in others).

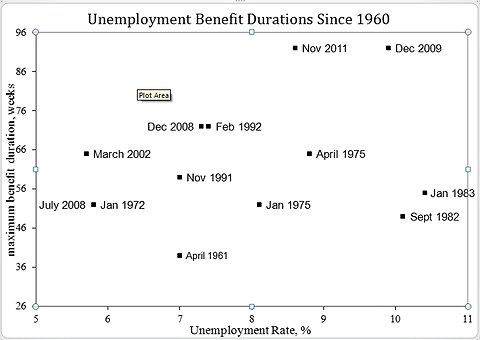

The maximum duration of benefits was much less in previous recessions. I examined the 12 episodes since 1960 when Congress increased the amount of time the unemployed could receive benefits, together with the most recent month with unemployment data (November 2011).

U.S. Department of Labor

U.S. Department of Labor

The vertical axis in the scatter diagram measures the maximum amount of time that the unemployed could receive benefits for each of the 12 law changes. The most recent law change was December 2009, when regular state and federal emergency and extended benefits could last up to 92 weeks (for comparability across recessions, here I ignore the few states that add seven additional weeks of extended benefits, bringing the total to 99).

We reached 92 weeks in a couple of steps. In July 2008, benefits began to last 52 weeks. Later that year, the maximum benefit duration was lengthened to 72 weeks.

In the 50 years before December 2008, the maximum benefit period was 72 weeks during the 1992 recession. Benefits lasted up to 65 weeks in the 2001-2 and 1975 recessions.

The horizontal axis graphs the unemployment rate at the time that unemployment insurance legislation was changed. Since 1960, only in the 1982 recession did the unemployment rate get so high. Nevertheless, unemployment benefits in that recession lasted at most 55 weeks – about three-fifths of the time that unemployment benefits last today.

Since the December 2009 law change, the unemployment rate has fallen, although nowhere near back to normal. With the recession officially ended almost three years ago, today’s unemployment rate is still similar to that in 1975 – one of the more severe recessions of the past. Still, when the unemployment rate was almost 9 percent in spring 1975, Congress decided to limit unemployment benefits to 65 weeks.

These comparisons may suggest that continuing or terminating emergency and extended unemployment benefits are not the only policy choices. The programs could be continued but perhaps with a lesser duration, such as 52 or 65 weeks as in previous severe recessions.

Article source: http://feeds.nytimes.com/click.phdo?i=8108571acc35a3a43236d39367bca844