It’s that last part of the equation that I’m going to focus on. My heart sinks every time I read a news story or opinion piece quoting employers who charge that four-year colleges and universities are failing to provide graduates with the skills they need to become and remain employable.

Of course, in many ways, this isn’t a new story.

“A four-year liberal arts education doesn’t prepare kids for work and it never has,” said Alec R. Levenson a senior research scientist for the Center for Effective Organizations at the University of Southern California.

Mara Swan, the executive vice president of global strategy and talent at Manpower Group, agreed.

“There’s always been a gap between what colleges produce and what employers want,” she said. “But now it’s widening.” That’s because workplaces are more complex and globalized, profit margins are slimmer, companies are leaner and managers expect their workers to get up to speed much faster than in the past.

“Employers are under pressure to do more with less,” Ms. Swan said.

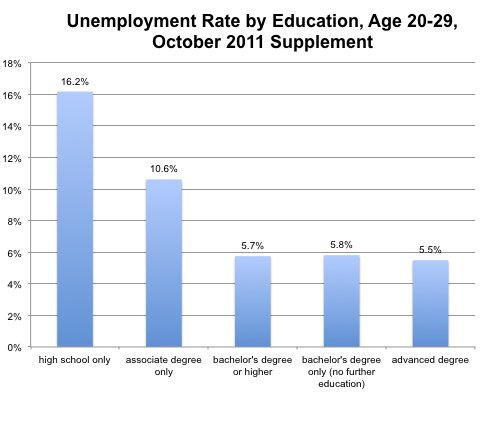

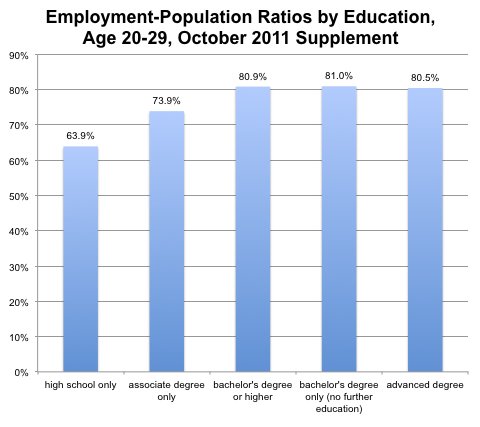

Unemployment rates for those with bachelor’s degrees or higher are still much better — at 3.8 percent in May — than those with only a high school diploma, which was 7.4 percent in May, according to the U.S. Bureau of Labor Statistics.

Nonetheless, a special report by The Chronicle of Higher Education and American Public Media’s Marketplace published in March found that about half of 704 employers who participated in the study said they had trouble finding recent college graduates qualified to fill positions at their company.

But, surprisingly, it wasn’t necessarily specific technical skills that were lacking.

“When it comes to the skills most needed by employers, job candidates are lacking most in written and oral communication skills, adaptability and managing multiple priorities, and making decisions and problem solving,” the report said.

Jaime S. Fall, a vice president at the HR Policy Association, an organization of chief human resources managers from large employers, said these findings backed up what his organization was hearing over and over from employers.

Young employees “are very good at finding information, but not as good at putting that information into context,” Mr. Fall said. “They’re really good at technology, but not at how to take those skills and resolve specific business problems.”

This isn’t a dilemma just in this country, but around the world, Ms. Swan said. A global study conducted last year of interviews with 25,000 employers found that nine out of 10 employees believed that colleges were not fully preparing students for the workplace.

“There were the same problems,” she said. “Problems with collaboration, interpersonal skills, the ability to deal with ambiguity, flexibility and professionalism.”

But it’s easy for the issue to degenerate into finger-pointing.

“If you sat down with a committee of professors, and told them students are not coming out with the skills they need, they would say, ‘you’re smoking something,’ ” Mr. Levenson said. “The trouble is, those skills are applied in a college context, not a workplace context.”

But, he added, “you can’t create a school-based curriculum that can help someone transition to being highly productive on the job in 10 days.”

In other words, the onus shouldn’t just be on universities; employers also need to step up to the plate.

The in-depth training programs and apprenticeships of the past are unlikely to come back, so companies must become more innovative in helping young employees come up to speed, according to a report released in May by Accenture, a management consulting and outsourcing company.

“Rather than simply bemoaning the inability to find employees with the skills required for available jobs, organizations must step up with new and more comprehensive enterprise learning strategies,” Accenture stated in a summary of The Accenture 2013 College Graduate Employment Survey, which queried 1,010 students graduating from college in 2013 and 1,005 who graduated in 2011 and 2012.

The problem, it said, is that most recent college graduates expect employers to provide on-the-ground training, but most of them don’t actually receive it.

E-mail: shortcuts@nytimes.com

Article source: http://www.nytimes.com/2013/06/29/your-money/a-quest-to-make-college-graduates-employable.html?partner=rss&emc=rss