TOKYO — Sony said on Thursday that it was weighing “carefully” a shareholder’s proposal to spin off part of its entertainment arm, but executives said signs of a turnaround in the Japanese company’s long-suffering electronics business showed that their strategy was on track.

Sony posted net income of 3.5 billion yen ($35 million) in the quarter that ended June 30, after a loss of 24.6 billion yen in the period a year earlier. The results were helped by a weaker yen and increased sales of smartphones. Revenue increased 13 percent, to $17.3 billion.

Company executives did not comment on a report in the Nikkei business newspaper that Sony was “leaning toward” rejecting the breakup proposal from Daniel S. Loeb, a New York hedge fund manager whose firm, Third Point, holds a 7 percent stake in Sony. Mr. Loeb wants the company to separate the entertainment unit from the electronics and financial divisions by selling stock in the unit and giving it its own board.

“We are going to discuss this carefully and then come to a solid conclusion,” Masaru Kato, Sony’s chief financial officer, said in a conference call with analysts.

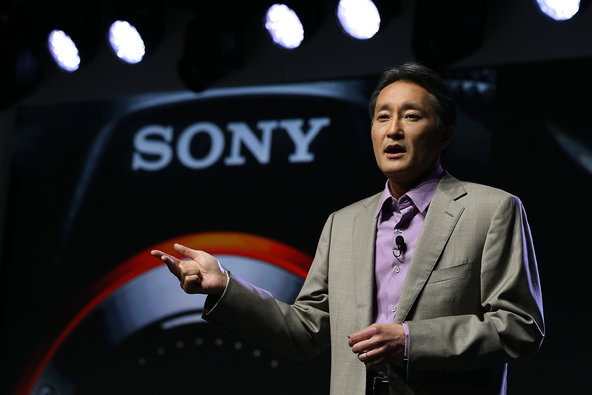

“Improving the profitability of electronics is the biggest priority of Mr. Hirai,” he added, referring to the chief executive, Kazuo Hirai. “At the same time, entertainment and financial services remain core parts of the business.”

Mr. Loeb stepped up his campaign for a breakup this week in a letter to Third Point investors in which he attacked Sony management over the weak performance of Sony’s Hollywood studio business. That unit has been hurt by poor box-office receipts for recent films like “After Earth” and “White House Down.”

In his letter, Mr. Loeb compared those films with the notorious Hollywood flops “Ishtar” and “Waterworld,” and added that the studio business was “characterized by a complete lack of accountability and poor financial controls.”

Sony confirmed the weak performance of the studio business in the quarter, saying sales had fallen 16 percent in constant currency terms.

In the electronics business, however, there were clear signs of a turnaround.

Although sales of video cameras and compact digital cameras have been caught up in an industrywide slide, Sony reported a “significant increase” in quarterly sales of smartphones, to 9.6 million from 7.4 million in the period a year earlier. Sony said average selling prices had risen as well, helping the mobile division post a profit of $60 million, after a loss of $28.1 million in the year-ago period.

Although analysts have questioned the value of retaining the broad array of product lines in which the company competes, they said the improved outlook had bolstered the position of Mr. Hirai as he tries to convince investors of the merits of keeping the company intact.

“It’s very clear that the company is focused on fixing electronics, and these results show that the strategy seems to be working,” said Damian Thong, an analyst at Macquarie Securities.

Even Mr. Loeb has acknowledged the improvement in the electronics operation. As he heaped scorn on Sony’s Hollywood management, he praised Mr. Hirai for “the green shoots increasingly visible in electronics.”

The strong performance of Sony smartphones like the Xperia Z has been complemented by a “perfectly executed” introduction of the company’s new game platform, the PlayStation 4, which is set to go on sale near the end of the year, Mr. Loeb wrote.

As a whole, Sony has benefited from a weaker yen, which makes revenue from products sold overseas worth more in Japan.

If not for the decline in the currency, Sony said, it would have reported a drop in revenue, largely because of falling sales of cameras and the sale of Sony’s chemical products business.

The results of other Japanese exporters reporting earnings this week, including Nissan and Panasonic, have also been bolstered by the weaker yen, a pillar of Prime Minister Shinzo Abe’s plan to stimulate growth in the Japanese economy.

Article source: http://www.nytimes.com/2013/08/02/business/global/sony-announces-370-million-quarterly-profit.html?partner=rss&emc=rss