CATHERINE RAMPELL

Dollars to doughnuts.

Uwe Reinhardt had a fascinating post Friday about the buffer that health care spending has provided in the last few years. Health care has provided a steady contribution to gross domestic product even as other sectors cut back dramatically. He also notes that in the last two decades, it has created more jobs on a net basis than any other sector.

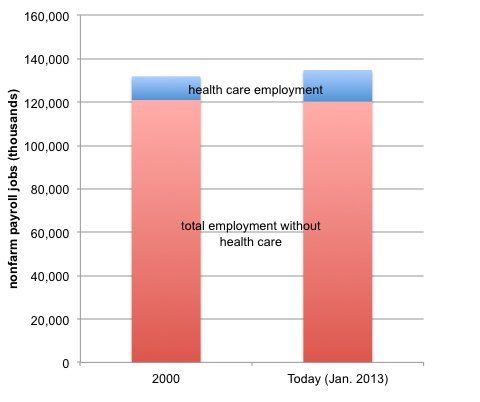

I’d like to point out one other important accomplishment of the much-maligned health care industry. Not only has it added more jobs than any other sector, but without it, there would actually be slightly fewer jobs in the United States today than in 2000.

In 2000, the economy had about 121 million non-health-care payroll jobs. Today, on a seasonally adjusted basis, there are 120 million non-health-care jobs. Meanwhile, the health care industry has added about 3.6 million jobs in that time frame, growing about 33 percent (14.5 million health care jobs today versus 10.9 million in 2000).

Source: Bureau of Labor Statistics, via Haver Analytics. January 2013 figures are seasonally adjusted; 2000 figures are annual numbers.

Source: Bureau of Labor Statistics, via Haver Analytics. January 2013 figures are seasonally adjusted; 2000 figures are annual numbers.

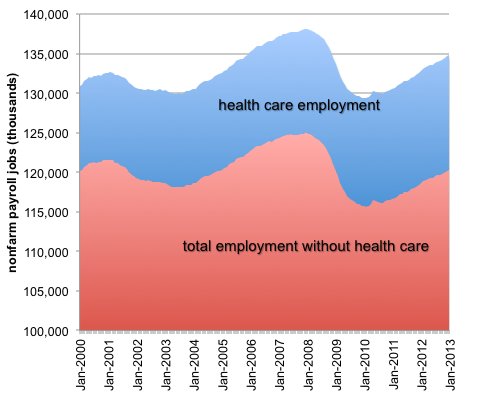

There have been times since 2000 that the country has had more non-health-care jobs on net than it had at the turn of the millennium, but that has not been true since late 2008. Here’s a look at the longer-term monthly numbers. Note that the vertical axis does not go down to zero to better show the change:

Source: Bureau of Labor Statistics, via Haver Analytics. Note that the vertical axis does not start at zero, better showing the change over time.

Source: Bureau of Labor Statistics, via Haver Analytics. Note that the vertical axis does not start at zero, better showing the change over time.

Is it a good thing that the health care industry has been basically keeping the job market afloat? That depends on your perspective.

Health care is a notoriously inefficient industry — in 2008, there were five people performing administrative support for every one doctor — and a lot of the jobs that have been created in recent years probably involve feeding that inefficiency.

Market pressures don’t force streamlining in health care the way they do in other industries. That’s partly because of the way Americans pay for health care and the way the government subsidizes health care consumption. It’s also partly because health care is relatively shielded from international competition, since many medical services are difficult to offshore. It’s hard to have someone draw your blood from India, for example.

In any case, given how weak the economy is right now, it seems unlikely that the health care industry is snatching many workers away from other industries where their skills would be put to more productive use.

Article source: http://economix.blogs.nytimes.com/2013/02/20/health-care-aside-fewer-jobs-than-in-2000/?partner=rss&emc=rss