The Commodity Futures Trading Commission has issued subpoenas to Goldman and owners of other major warehouses as part of its inquiry into irregularities in the aluminum market that are believed to have cost consumers billions of dollars since 2010.

The subpoenas seek all internal documents, e-mails, correspondence, voice recordings and other records concerning the warehouse operations dating back to January 2010, according to two people familiar with the documents. The subpoenas also demand documents and correspondence regarding the London Metals Exchange, a private trade association that regulates warehousing. The subpoenas indicate that the federal inquiry has 30 “areas of interest.”

Goldman bought Metropolitan International Trade Services, a string of Detroit-area metals warehouses, in 2010 and soon afterward beverage makers and manufacturers began complaining that the company was restricting the outflow of metal, causing lengthy delays in delivery. Those waits, which grew from six weeks in 2010 to around 16 months now, mean higher storage costs for metal owners, who are charged rent by the day.

Because of a quirk in the formula used to set the price of aluminum on the spot market, the delays also increase the prices nearly all manufacturers pay for aluminum even when they buy metal that was not stored in a warehouse.

Industry analysts and beverage makers estimate that long queues cost manufacturers and consumers more than $5 billion.

Federal regulators began examining the metals warehouses last month, after The New York Times reported that Metropolitan had been paying metal owners an incentive to move their aluminum from one warehouse to another, which contributed to the delays.

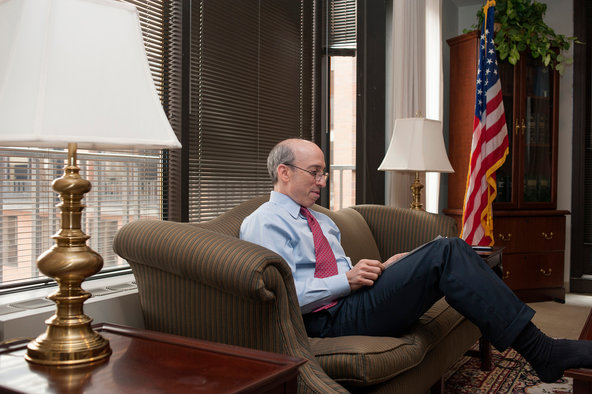

Michael DuVally, a Goldman spokesman, declined to comment on the subpoenas. But during the last month, Gary D. Cohn, Goldman’s president, has said that the company’s warehouse subsidiary never violated any laws or regulations, moved metal only when its customers requested it and never sought to inflate aluminum prices.

Other major metal warehouses in the United States are owned by Glencore Xstrata and Noble, but it was unclear whether those companies had also received subpoenas.

Dennis W. Holden, a spokesman for the C.F.T.C., declined to comment on the issuance of the subpoenas, which was first reported by Reuters.

The investigation by federal regulators is part of a of a wave of scrutiny Goldman is now under for its dealings in the commodities markets.

Beverage manufacturers and the aluminum sheet supply company Novelis have asked the Justice Department to look into whether the warehouse operations violated antitrust laws, but it is unclear whether a formal inquiry has been started.

Some aluminum owners have filed class-action suits against Goldman. The Federal Reserve is also reviewing whether Goldman and Morgan Stanley have complied with an exemption to the merchant banking law that allows them to own warehouses, refineries, pipelines and other facilities used to store and transport commodities.

Article source: http://www.nytimes.com/2013/08/13/business/us-subpoenas-goldman-in-inquiry-of-aluminum-warehouses.html?partner=rss&emc=rss