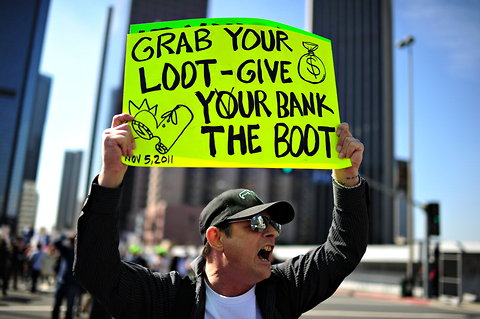

Agence France-Presse — Getty ImagesAn anti-bank protester in Los Angeles.

Agence France-Presse — Getty ImagesAn anti-bank protester in Los Angeles.

The numbers sounded a bit too good to be true — and it turned out that they were. The Credit Union National Association now says that about 214,000 people joined credit unions in the month or so of anti-bank fervor this fall, not the 650,000 it originally estimated. As Gov. Rick Perry of Texas might say: “Oops.”

The credit union association attributed the difference to ambiguous wording in a survey that may have been misinterpreted by some credit unions. The association had asked its members to gauge the impact of Bank Transfer Day, Nov. 5, which had been designated by a grass-roots movement as the day for customers to switch from big banks to credit unions. The event was spurred in part by the backlash against the decision by big banks, including Bank of America, to charge customers a monthly fee for using their debit cards.

The survey wording apparently led some credit unions to report estimates not only of new members, but also of new checking accounts opened by existing members, in the weeks leading up to Bank Transfer Day, an association spokesman, Mark Wolff, said in an e-mail. (The revision was first reported by American Banker).

When the credit union association received its regular monthly data in October (information the association considers reliable, because it has been gathered for 30 years), the discrepancy became apparent. Actual growth now appears to have been 227,000 new members in September, and 214,000 in October, Mr. Wolff said.

“The combination of new members In October and new checking accounts from existing members would put the total close to the 650,000 estimate in our earlier pre-Bank Transfer Day survey,” he said.

The association says it believes credit union members who did not have a credit union checking account were opening the accounts at credit unions, probably because of fee increases at big banks.

The initial survey was “neither scientific nor a representative sample,” Bill Cheney, the association’s president and chief executive, said in a statement. Still, he said, it is clear that consumers made a “significant movement” to credit unions in the weeks leading up to Bank Transfer Day, either by joining credit unions or opening new accounts. The addition of 441,000 new members over two months represents about 75 percent of total credit union membership growth in 2010.

Did you open a new account at a credit union on Bank Transfer Day?

Article source: http://feeds.nytimes.com/click.phdo?i=f9e63b08436b73e6ba0558882320653b