Carl Richards

Carl Richards

Carl Richards is a certified financial planner in Park City, Utah. His new book, “The Behavior Gap,” was published earlier this month. Here is an excerpt from his book. His sketches are archived here on the Bucks blog.

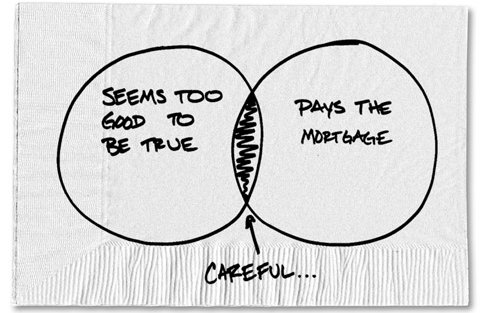

Bernie Madoff spent most of the last two decades running the largest Ponzi scheme in history, defrauding thousands of investors of billions of dollars. Many of those investors were intelligent, sophisticated people. Some were top managers at major Wall Street firms.

So what happened? Same old, same old. He promised the moon, and we wanted to believe he could deliver it.

There were warning signs. Many people on Wall Street had their suspicions of Madoff. A few were flat-out convinced that he was a fraud (and tried to tell the Securities and Exchange Commission and other regulators). Some Wall Street firms avoided doing business with the guy.

Others kept sending clients to him.

Patricia Wall/The New York Times

Patricia Wall/The New York Times

It would be nice to blame the whole thing on a few dirty rotten scoundrels. But that’s too easy. Part of the problem lies with our almost universal tendency to believe what we want to believe. It’s really, really hard to resist a deal that looks too good to be true — especially when other people are buying into it.

I understand why people invested with Madoff. The guy had great credentials, and his record was very strong. Most folks didn’t ask questions. They wanted those returns, and they trusted their advisers to protect them. Their advisers, in turn, trusted regulators. And regulators didn’t get the job done.

Whatever. The fact remains that some pretty sophisticated people didn’t nail down the facts before they put money (their own and/or their clients’) at risk.

It happens all the time. Few people asked many questions when supposedly conservative bankers started offering high-yielding but risky new products to mainstream investors, like derivatives and securities backed by subprime loans. Meanwhile, we kept borrowing more money even as we sensed that no-money-down mortgages made little financial sense. The banks offered us cheap access to money, so we didn’t ask questions. We took it, and hoped for the best.

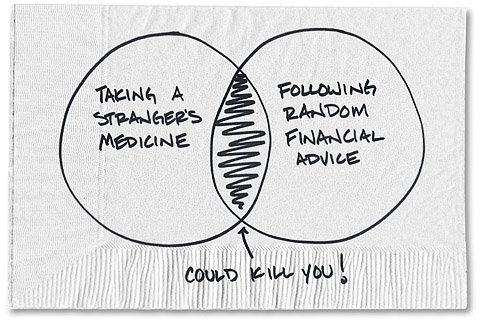

You, me, and most everyone else struggle to work up the nerve to question things that appear too good to be true. But as usual, it turns out that our financial security is our own responsibility. And sometimes, that means we have to be skeptics.

Excerpted from “The Behavior Gap: Simple Ways to Stop Doing Dumb Things With Money,” published by Portfolio/Penguin. Copyright © Carl Richards, 2012. Reprinted with permission.

Article source: http://feeds.nytimes.com/click.phdo?i=82a45962bf8332a409c157e77a0cb2e5