Courtesy of Blaine Gary

Courtesy of Blaine Gary

Branded

An insider’s guide to small-business marketing.

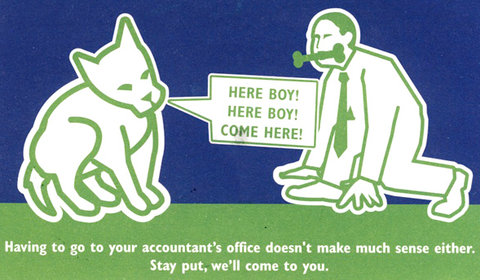

A few weeks ago, I received the above postcard in the mail. It didn’t hit me at first. As the owner of an advertising agency, I see a lot of in-your-face marketing efforts. But after spending a few minutes with it, I started to admire the way this service business — a certified public accountant, no less — was trying to differentiate itself from the pack.

Its simple message certainly resonated with me: Why do so many of us make that annual schlep to our accountant’s office with boxes full of receipts and files? Why don’t our accountants come to us? Why don’t we see them more than once a year?

Intrigued, I called Blaine Gary, C.P.A. I got a voice mail message that assured me my call would be returned within the next 24 hours. The recording signed off with, “Blaine Gary, the C.P.A. with personality.”

When we connected (within 24 hours), I was pleasantly surprised by how much I learned about business development from Mr. Gary, who is just 32 and had moved to Austin four months earlier. I asked him how he had come up with his messaging. Turns out, he had done his homework, starting with asking small-business owners questions about their relationships with their accountants, like how often they see them.

“I found out many small businesses have worked with the same person for 25 or 30 years, and that they have a good relationship,” he said. “I know they are not going to move over for me.” And yet, just because a business owner has a good relationship with an accountant doesn’t mean the business’s needs are being met. “The reality is,” Mr. Gary said, “their C.P.A.s are grey-haired guys on their way out, and the last thing they want is more business. I’m convinced most professionals — while great at what they do — don’t understand customer service at all. We call you back within a day, and most accountants don’t. You have to badger your attorney and keep him motivated on what he’s supposed to be working on, and then you get these mystery bills in the mail.”

I was startled. That description fit my C.P.A. perfectly. I have a great personal relationship with the accountant who has done my taxes for more than 20 years. Is he eligible for A.A.R.P.? Check. Do multiple calls and e-mails routinely go unanswered? Check. Once-a-year visitations at his office? Check! There was even one year when I really needed him to finish my taxes by April 15 — instead of requesting the usual extension — so I could get my refund. To encourage him to get my taxes done on time, I offered him a case of wine. He agreed and delivered the returns, and I made good on the vino. What’s wrong with this picture?

Most C.P.A.’s, Mr. Gary explained, are hard-core introverts. “If you’ve ever done the DiSC personality profiles, they are a high C typically.” Accurate, analytical, conscientious, careful. “When I started out,” he said, “I was wearing a white shirt during the day, banging it out in accounting departments, and then on the weekends, I was out riding my motorcycle, listening to live music. When I passed the C.P.A. exam, a lot of people asked me if I passed it on the first try. I always answer, ‘I have too much personality for that.’ I didn’t want to be the passive, introverted accountant. I told people I was the C.P.A. with personality. People always get a laugh out of it, but they remember it.”

My agency does a lot of branding and positioning work for a variety of companies, and the process always gets interesting when we ask a client’s target audience about wants and needs that are being left unfulfilled. It’s a process that can take anywhere from six weeks to several months, depending on the complexity and the amount of research required.

But — just as Mr. Gary proved — it’s something any small business can do effectively. Pick up the phone. Network. Ask questions. Compare what your target customers want to what your company is delivering. What do you offer that your competitors don’t? Too many businesses promise to do something vague like “exceed expectations” (Google it. I got 2.8 million results). Too many businesses promise a laundry list of benefits and say they do them faster, better, cheaper — but they fail to connect the dots to the emotional needs of their potential customers. A good positioning should answer this question: What does your company do that your competitors do not and that your target audience wants and needs?

In Mr. Gary’s case, he came to understand the accounting needs of his small-business audience better than many small-business owners, like me, who never stop to think we deserve better. He has found his postcard campaign highly effective in getting his message out there — much better than his old Web site and his constant networking. “A graphic designer friend of mine said, ‘Wouldn’t it be great if you didn’t have to be at the Chamber or the Lions Club all the time?’ ” he said. “That’s why you got that postcard in the mail — I have five different versions I send out and then follow up with a phone call.”

He finds that people hold on to his postcards for four to five months or a year. And then when they have one more less-than-stellar experience with their C.P.A., his phone rings. I’m not sure I can explain why, but this small-business owner has not yet made the call. I guess I’m just not ready to sever my long-term relationship with my C.P.A. Maybe we’ll see how many bottles of wine a timely tax return might run this year.

MP Mueller is the founder of Door Number 3, a boutique advertising agency in Austin, Tex. Follow Door Number 3 on Facebook.

Article source: http://feeds.nytimes.com/click.phdo?i=c5c9a2cf990ffcd32063c213859045a7