Carl Richards is a certified financial planner in Park City, Utah, and is the director of investor education at The BAM Alliance. His book, “The Behavior Gap,” was published this year. His sketches are archived on the Bucks blog.

I know it’s been in the news, but if you haven’t seen the recent “Frontline” program “The Retirement Gamble,” you have to take an hour and watch it. I know, it doesn’t sound like as much fun as watching reruns of “Seinfeld.” But sometimes adults have to do things that aren’t fun.

There are so many important points in this show I could talk about. But I want to focus on one narrow but incredibly important thing: Investment fees matter…a lot!

To set this up here, there is a conversation that happens about minute 32 that had me out of my chair I was so mad:

Martin Smith, “Frontline” correspondent: The problem is that these fees are not paid by the fund company. The bill is passed to you and me. Here it is, buried deep in my 401(k) plan documents. It took me about an hour to find the reference.

[On camera] Do you think the industry could do a better job of making people aware of the effective fees on their savings?

Karen Wimbish, retirement executive, Wells Fargo: I think we could make people aware of the effect of every pressure that they have on their accounts.

Martin Smith: What stands in the way of doing that better job?

Karen Wimbish: [laughs] I— what I would tell you is, it’s— sometimes, it’s very difficult to get people to focus on something that seems complicated and dull and boring. So could we do a better job with helping consumers understand all the things that are tied to what they just bought, whether it’s financial services or the riding lawn mower? Yes. It’s too complicated.

Let me repeat one phrase from Ms. Wimbish:

…it’s very difficult to get people to focus on something that seems complicated and dull and boring.

Let’s start with complicated.

It’s true that Wall Street has made it way too hard for us to figure out what we’re paying for the privilege of investing our own money for retirement. And while I don’t want to sound like I’m blaming the victim, the average American adult is likely to think nothing of spending 10 hours a week watching TV, another 10 hours surfing the Web, and another 10 tweeting on Twitter. But then he or she complains that figuring out the expenses in our 401(k) is too complicated and not entertaining.

Please don’t misunderstand me. I know there are hidden fees. I know it’s hard to read a prospectus and the other materials that come when you sign up for a 401(k). I agree that the 401(k) might be a failed experiment, and yes, we need reform and change. In the meantime, it’s what we have. And the benefits of tax deferral are still worth it, particularly if you’re lucky enough to get the rare employer match.

I refuse to believe that the average American adult can’t figure it out.

Now, how about dull and boring?

Yes, taking the time to figure out the lowest fee options in your 401(k) might not be as entertaining as watching football. But does something as important as our retirement have to be entertaining for you to concentrate on it?

This is important enough to just grit your teeth and figure it out. If you think this is dull and boring, imagine for a minute how dull and boring retirement is with no money.

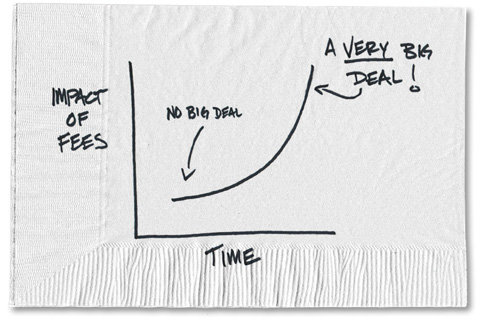

It’s boring in the short term to figure out how to lower your expenses by an amount that appears so small. After all, aren’t we talking about 1 or 2 percent here?

Sounds like no big deal, and in the short term it isn’t a big deal. But as we’ve all heard, it adds up. The compound effect of 1 or 2 percent over 25 or 30 years is huge. It’s worth the time.

Please accept that you have a responsibility to do the hard work of learning to understand this stuff before it’s too late. Like the two retired teachers in “The Retirement Gamble” say:

We never planned on learning about investments, until we got slammed in the gut.

Getting slammed in the gut seems like something we all want to avoid.

Article source: http://bucks.blogs.nytimes.com/2013/05/06/the-dull-task-of-decoding-401k-fees-matters/?partner=rss&emc=rss