CATHERINE RAMPELL

Dollars to doughnuts.

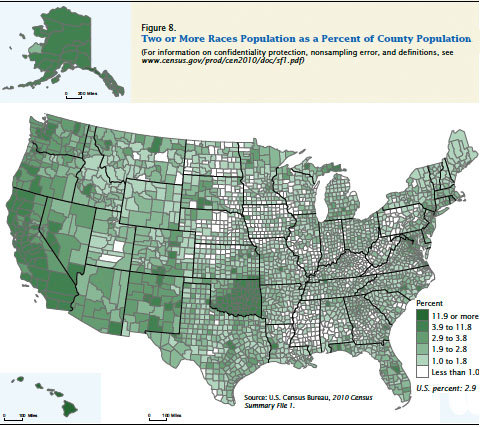

That map is from a new Census Bureau report about the population of mixed-race Americans, which grew 32 percent from 2000 to 2010. The population of single-race Americans, by contrast, grew 9.2 percent.

As a share of the total population, mixed-race Americans are still a tiny minority, just 2.9 percent, or about nine million people.

As you can see in the map, the states with the highest share of residents who report being of more than one race are Hawaii (23.6 percent), Alaska (7.3 percent), Oklahoma (5.9 percent) and California (4.9 percent).

Four distinct mixed-race combinations represented about 92 percent of all mixed-race people: people who reported being both white and black totaled 1.8 million; white and “some other race,” 1.7 million; white and Asian, 1.6 million; and white and American Indian and Alaska native, 1.4 million.

Article source: http://economix.blogs.nytimes.com/2012/09/27/mixed-race-america/?partner=rss&emc=rss