Carl Richards is a certified financial planner in Park City, Utah, and is the director of investor education at The BAM Alliance. His book, “The Behavior Gap,” was published this year. His sketches are archived on the Bucks blog.

If you’re my generation or older, you probably remember Peter Lynch.

He was the famous manager of Fidelity’s Magellan Fund from 1977 to 1990. While Mr. Lynch’s track record covers only 13 years, it’s easy to see why many consider him to be one of the greatest investment managers of all time.

When he took over the fund in 1977, it had only $18 million in assets. But when he retired in 1990, the fund had grown to $19 billion in assets. Over those 13 years, Mr. Lynch managed to achieve a compounded average investment return of 29.2 percent, while the Standard Poor’s 500 Index only rose 15.8 percent

On top of being a great manager, Mr. Lynch was also a prolific and talented writer. It was said that his approach to investing was so simple and clearly written in his books — ”One Up on Wall Street” and “Beating the Street” — that he inspired many do-it-yourself investors and future managers.

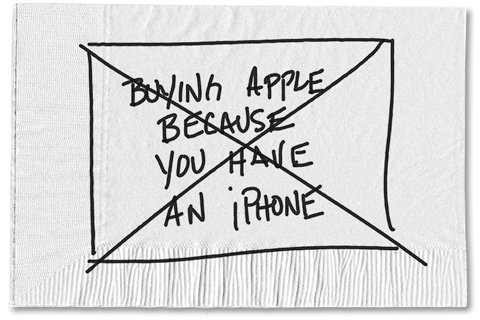

I have a favorite Lynch saying: “Never invest in any idea you can’t illustrate with a crayon.” I think my reasons for liking that particular one are obvious. But I’m seeing a troubling trend related to another one of Mr. Lynch’s ideas: Invest in what you know. People are using it to justify dangerous investing decisions.

This brand of investing was made famous by the great stories that Mr. Lynch told, particularly about individual stocks. For instance, he once told a story about how his wife loved a new Hanes product so much — L’eggs pantyhose — that he bought Hanes stock. It became the largest portion of the fund, and fundholders eventually enjoyed a 30-fold appreciation in the stock.

As fun as it can be to hear these stories, when they are viewed in isolation they can be incredibly dangerous for investors. And Mr. Lynch isn’t alone in being taken out of context. Warren Buffett has offered similar advice about how you should never invest in businesses that you don’t understand.

But here’s the thing we need to remember: Whatever the advice, it’s just the starting point for investors like Mr. Lynch and Mr. Buffett, not the end point. Yes, they may have started with things they knew. But they also did a bunch of research, and it’s this second part that’s missing from many investors’ decision-making process.

It seems crazy to assume that buying what you know should replace research, but that doesn’t seem to be stopping people. I’ve heard more than one person justify a decision to buy Apple stock because they really love their iPhone. That’s about as wise as buying Crumbs’ stock because you love their cupcakes. But that doesn’t seem to have stopped individual investors from buying shares of Apple. As a Times story noted last week:

The investment firm SigFig estimated last fall that 17 percent of all retail investors owned Apple stock, four times the number that owns the average stock in the Dow Jones industrial average.

If you pick and invest in individual stocks, what you’re really doing is focusing on just one piece of Mr. Lynch and Mr. Buffet’s advice. And for most of us, that’s just too risky. It makes more sense to invest in diversified, low-cost index funds. (In fact, Mr. Buffet bet that an index fund would beat a set of hedge funds; he’s winning that bet.)

And even though Mr. Lynch and Mr. Buffett clearly stand above the rest of us mere mortals, one piece of their advice doesn’t replace the other requirements of good investing behavior.

Article source: http://bucks.blogs.nytimes.com/2013/04/22/the-perils-of-investing-in-what-you-know/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.