Carl Richards is a certified financial planner in Park City, Utah, and is the director of investor education at the BAM Alliance. His book, “The Behavior Gap,” was published this year. His sketches are archived on the Bucks blog.

“I know you can’t time the market. But in your view, where is the market going?”

I still get this question from people, at event after event, even after people have heard me talk about the importance of behavior and how we can’t predict short-term market performance.

During a recent trip to South Africa, I got even more specific questions:

- Where is the United States economy headed?

- Where are interest rates headed?

- Is now a good time to invest in Japan?

- Is the housing recovery for real?

Here’s the thing: I totally understand why people are asking questions about timing. First, there’s an assumption that having an opinion — whether it’s about the market, the economy, or Japan — makes someone look smart. Being able to talk about these subjects must mean you have more money and your investments do better, right?

Not true.

Second, if you don’t talk about sports or politics that only leaves economic issues (Again, not true. It just feels that way). Now maybe you like to talk about all three, but it’s reached the point where talking about the economy and markets is an official spectator sport. We all feel capable of playing.

And while it may be fun to chat about what the market might do next at your neighborhood barbeque, don’t kid yourself. What we know about the market comes down to a bunch of guesses, also known as forecasts.

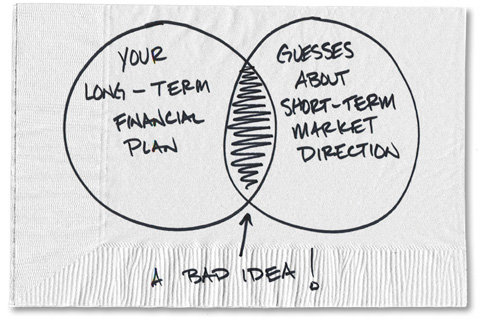

Forecasts about the future of the market are very likely to be wrong, and we don’t know by how much and in which direction. So why would we use these guesses to make incredibly important decisions about our money?

That’s right. You shouldn’t because you know better, and relying on what’s really just a hunch is an all but guaranteed recipe for financial pain.

Instead of relying on guesses to dictate our financial decisions, we need to focus on the investing basics:

- Figure out where you are today

- Make a guess about where you want to go

- Buy diversified, low-cost investments that have the best shot of getting there

- Behave for a long time

Obviously, this list isn’t nearly as interesting as speculating about whether the Dow will break 16,000 before the end of the year. But it is a list that will keep you from doing something dumb, like thinking it’s a good idea to bet your portfolio on a guess.

So, just in case I’ve left you in doubt, please don’t forget: Plans and guesses don’t mix!

Article source: http://bucks.blogs.nytimes.com/2013/07/01/investment-plans-and-forecasts-dont-mix/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.