This month, the majority of Republicans in the House and the Senate voted to raise the debt limit without doing anything to rein in spending.

Republican lawmakers are pushing to increase military spending by tens of billions of dollars, topping even Mr. Trump’s request for a beefed-up military. Democrats are sharing in the fiscal intemperance, lining up behind a “Medicare for all” proposal despite having no definitive plan for how to pay for universal, government-provided health coverage.

And as Congress mulls large tax cuts, the tabs for Hurricanes Harvey, Irma and Maria keep rising.

When Mr. Bush took office and pushed for a big tax cut, the fiscal outlook was strong. The Congressional Budget Office in 2001 was projecting $5.6 trillion in budget surpluses over 10 years.

Now, the budget office forecasts that deficits will total $10.1 trillion over the next decade. The deficit is expected to top $1 trillion a year in 2022 and keep growing from there. Federal debt held by the public is at the highest level since shortly after World War II, at 77 percent of the gross domestic product.

“I think the greatest threat to our nation is us,” warned Senator Bob Corker, Republican of Tennessee and a member of the Senate Budget Committee. “The way we handle our finances, we as a nation are the greatest threat to our nation. It’s not ISIS. It’s not North Korea. It’s not ascendant China. It’s not Russia. We are the greatest threat.”

But such voices are strangely quiet these days in Washington. Even Mr. Corker seems accommodating.

Last week, he reached a deal with another Republican on the budget panel, Senator Patrick J. Toomey of Pennsylvania, to allow a tax cut of up to $1.5 trillion over a decade, helping pave the way for the overhaul of the tax code that is a top goal for Mr. Trump and congressional Republicans. He did say he would not vote for a final tax plan if it would add to the deficit.

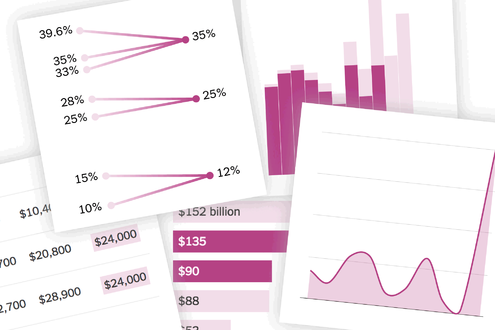

Graphic

Six Charts That Help Explain the Republican Tax Plan

The proposal lowers rates for individuals and corporations but leaves key elements up to Congress.

The mantra now is economic growth.

“Every Republican I know of is concerned about the deficit,” said Senator John Kennedy, Republican of Louisiana. “Every Republican I know of is concerned about tepid growth, too.”

Advertisement

Continue reading the main story

While Republicans denounced the ballooning debt when President Barack Obama was in office, they have much less of a political incentive to dwell on the issue now that their party controls the government.

Newsletter Sign Up

Continue reading the main story

Thank you for subscribing.

An error has occurred. Please try again later.

You are already subscribed to this email.

“There’s been less talk about it this year with a Republican-led administration than there has been the last seven or eight years,” said Mr. Walker, who bristled at the Senate’s plan for tax cuts that would add to the deficit. He said it was imperative that lawmakers pay attention to the debt.

Maya MacGuineas, the president of the Committee for a Responsible Federal Budget, said it seems like “fiscal responsibility is more about playing defense than it really is caring about the issue.”

“The party that is the minority, you hear them talk about fiscal responsibility so much more to try to stop the other party from implementing their agenda,” she said. “But then when that party gets in power, and you’re seeing that now, they’re more likely to throw those fiscal concerns to the wayside in order to implement their agenda without having to face any of the hard choices about how to pay for things.”

Representative Mo Brooks, Republican of Alabama, said his party deserves blame. He warned that the United States could wind up facing an economic collapse akin to that in Venezuela, adding that Republicans in the House and Senate had not demonstrated that they possess “the intellectual understanding of the dangers posed by these deficits and accumulated debt.”

Mr. Trump, who has called himself “the king of debt,” may be setting the tone.

During his presidential campaign, he insisted that he could eliminate the national debt in eight years, even as he promised to protect Social Security and Medicare, programs that are projected to consume an ever larger share of federal spending as the country’s population ages.

After Mr. Trump struck a deal with Democrats on a short-term debt limit extension, Representative David Schweikert, Republican of Arizona, asked, “In this entire discussion, how many members have you heard, how many from the White House said, ‘We’re in the middle of a demographic crisis that’s going to crush us in just a few years; let’s get to work on it’?”

He left unsaid the answer to his question: Not many.

The change in tone on fiscal matters has been swift. This spring, Senator Mitch McConnell of Kentucky, the majority leader, asserted that the tax overhaul needed to be revenue neutral, citing the nation’s debt and invoking Mr. Trump’s Democratic predecessor.

“We added an enormous amount of debt during the Obama years,” Mr. McConnell said.

Now, Republican lawmakers are betting that economic growth will fix the nation’s fiscal woes with no pain and a lot of gain.

“The only way we’re going to solve our long-term debt and deficit issue to allow the federal government to have the revenue it’s going to need to fund all these promises made is with strong — and I mean strong — economic growth,” said Senator Ron Johnson, Republican of Wisconsin and a member of the Senate Budget Committee. “You’re not going to achieve that with an awful tax system.”

Advertisement

Continue reading the main story

Mr. Kennedy, another member of the budget panel, said Americans have to have faith.

“If we do it right, then the economy will be stimulated appropriately and tax revenues will go up and the deficit won’t increase,” Mr. Kennedy said. “Now, I can’t prove to you that that will happen. But neither can anybody else.”

Continue reading the main story

Article source: https://www.nytimes.com/2017/09/28/us/politics/trump-tax-cuts-deficit-republicans-congress.html?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.