Bruce Bartlett held senior policy roles in the Reagan and George H.W. Bush administrations and served on the staffs of Representatives Jack Kemp and Ron Paul. He is the author of “The Benefit and the Burden: Tax Reform – Why We Need It and What It Will Take.”

Last week, the Internal Revenue Service posted the latest individual income tax data for tax year 2010. Supporting the Republican worldview, the data show that the share of total income taxes paid by the rich increased; supporting the Democratic worldview, they show that the wealthy’s share of total income increased more, leading to a decline in their average tax rate. Sorting through these competing facts is a bit like determining whether the glass is half-empty or half-full, but I’m going to try.

Today’s Economist

Perspectives from expert contributors.

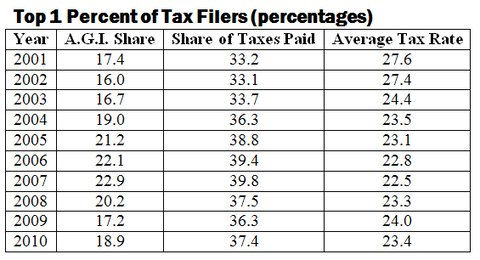

I will start with the top 1 percent of income taxpayers, who are unambiguously rich by any definition of the term. In 2010, this group included all tax filers with adjusted gross incomes above $369,691. Remember that A.G.I. excludes many forms of income, including benefits such as employer-provided health insurance, unrealized capital gains and interest on tax-exempt municipal bonds.

Internal Revenue Service

Internal Revenue Service

Conservatives like to contend that the increasing share of federal income taxes borne by the wealthy shows that they are carrying the rest of us on their backs, so to speak. Indeed, the percentage of all income taxes paid by the top 1 percent has risen to 37.4 percent from 33.2 percent in 2001. This necessarily means that the share of the bottom 99 percent has fallen.

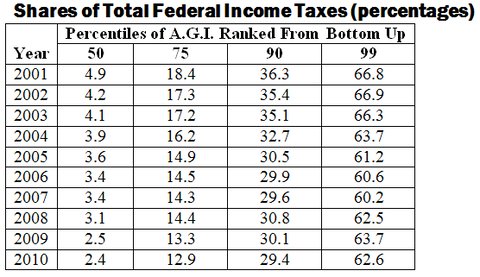

The following table shows that in fact the share of total income taxes borne by those with lower incomes has indeed fallen. For example, the bottom 90 percent of tax filers now pay 29.4 percent of all income taxes, compared with 36.3 percent in 2001.

Internal Revenue Service

Internal Revenue Service

Liberals note that a key reason for this is that the incomes of most people outside the rich have stagnated or fallen. In 2001, it required an income of $23,187 in 1990 dollars to be in the top 50 percent of tax filers; in 2010, that income figure had fallen to $20,586. Concomitantly, the share of total income accruing to the bottom 50 percent fell to 11.7 percent in 2010 from 14.4 percent in 2001.

Another key reason for the declining share of income taxes paid by the nonwealthy is that Republican tax policy since the 1970s has consciously aimed at reducing their tax burden.

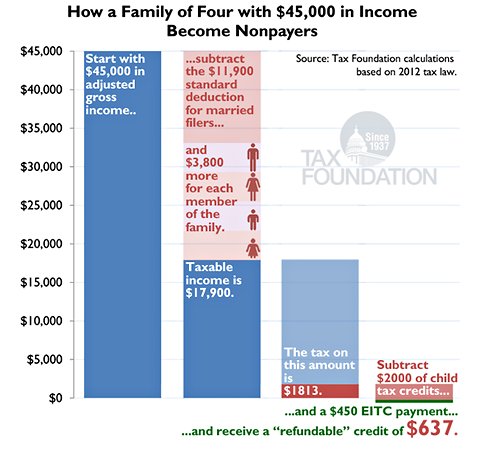

The following chart from the conservative Tax Foundation illustrates how Republican-sponsored increases in the personal exemption and creation of the earned-income tax credit and child credit completely eliminates the income tax liability for a family of four with $45,000 of income.

Tax Foundation

Tax Foundation

The declining share of income taxes paid by the nonwealthy was at the root of Mitt Romney’s charge that 47 percent of Americans are dependent on government. After the election, he attributed his loss to “gifts” that certain constituencies, “especially the African-American community, the Hispanic community and young people,” receive courtesy of taxpayers.

Needless to say, there are many problems with this grossly simplistic view of who gets government benefits and who pays for them.

It’s undoubtedly the case that a great many of the elderly still think of themselves as taxpayers even though they may not have actually paid any income taxes in years. Nor do they view themselves as receiving gifts in the form of Social Security and Medicare benefits. They believe they paid for these benefits from taxes during their working lives and would resent being characterized as moochers.

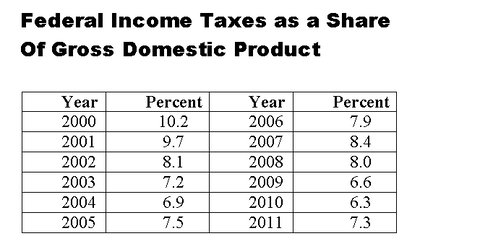

Another problem is that when Republicans talk about the rising share of income taxes paid by the wealthy, I think they are implicitly assuming that the government is still paying for all its spending with taxes. But it’s not; the federal government has run deficits since fiscal year 2002, to a large extent because of tax cuts. According to the Congressional Budget Office, lower revenues have been responsible for about half the increase in the national debt since 2001, about half of which resulted from legislated tax cuts and half from slower-than-expected growth.

Congressional Budget Office

Congressional Budget Office

Across-the-board tax cuts financed with deficits will necessarily raise the share of taxes paid by those with upper incomes. Consider this example. The government raises $10 in taxes and it is divided among three taxpayers. Ms. Poor pays $1 (10 percent), Ms. Middle pays $3 (30 percent), and Ms. Rich pays $6 (60 percent). Now the government gives everyone a $1 tax cut and its revenues fall to $7. Ms. Poor now pays nothing, Ms. Middle pays about the same percentage (29 percent), but Ms. Rich now pays 71 percent. Everyone received a tax cut, but the tax shares are now skewed much more toward the wealthy.

In a general sense, this is what has happened to the income tax and illustrates why it is possible for effective tax rates on everyone to fall and at the same time raise the share of taxes paid by the wealthy.

Article source: http://economix.blogs.nytimes.com/2012/11/27/tax-cuts-tax-rates-and-tax-shares/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.