The Dow Jones industrial average and the Standard Poor’s 500-stock index climbed to fresh highs on Thursday after data showed new jobless claims dropped more than expected.

The S.P. 500 and the Dow each rose 0.4 percent; the Nasdaq composite index was flat.

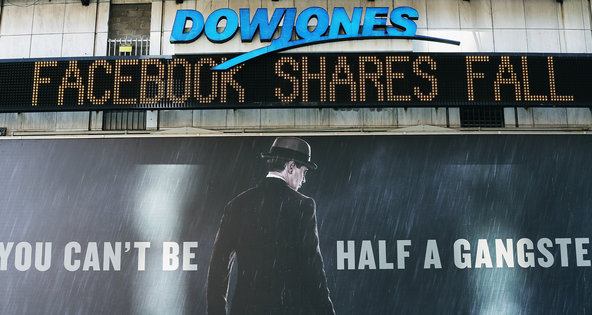

Technology stocks were the day’s underperformers. Tech blue chips like Microsoft and Hewlett-Packard were sharply lower after an industry report showed shipments of personal computers had fallen significantly in the first quarter. Microsoft was also hit after Goldman Sachs cut its rating on the stock to sell from neutral.

“It’s not a good day for technology stocks, but over all, we are in a strong market,” said Joe Bell, senior equity analyst at Schaeffer’s Investment Research in Cincinnati. “It’s encouraging to see how the market starts off weak on a bit of natural profit-taking, and then market participants instantly bid the market higher.”

Among the blue chips, three of the Dow’s five biggest gainers — Pfizer, Boeing and Home Depot — hit new 52-week highs.

Before the opening bell, Labor Department data showed initial claims for state unemployment benefits fell much more than expected last week, giving relief to investors who were rattled last Friday by a much weaker-than-expected nonfarm payrolls report.

The Dow reached a new intraday high at around 11:21 a.m. and extended that to a fresh record by early afternoon. The S.P. 500 quickly followed the Dow’s lead in late-morning trading, climbing to a new intraday high of 1,597.35 at 11:29 a.m.

On Wednesday, both the Dow and the S.P. 500 rose more than 1 percent to close at new highs after three straight days of gains.

The Dow got its biggest boost from Pfizer, up 2.6 percent, after JPMorgan raised its target price on the drugmaker’s stock.

A leading tech tracking firm said personal computer sales plunged 14 percent in the first three months of the year, the biggest decline in two decades of keeping records, in a report released after Wednesday’s closing bell.

Hewlett-Packard fell 6.8 percent, Microsoft shed 4.9 percent and Intel lost 2.8 percent. The S.P. information technology sector index slipped 0.6 percent.

Shares of Acadia Pharmaceuticals surged 57.3 percent after the drug maker said data from an initial late-stage trial would be sufficient to file for approval for its experimental antipsychotic drug for Parkinson’s disease patients.

Article source: http://www.nytimes.com/2013/04/12/business/daily-stock-market-activity.html?partner=rss&emc=rss