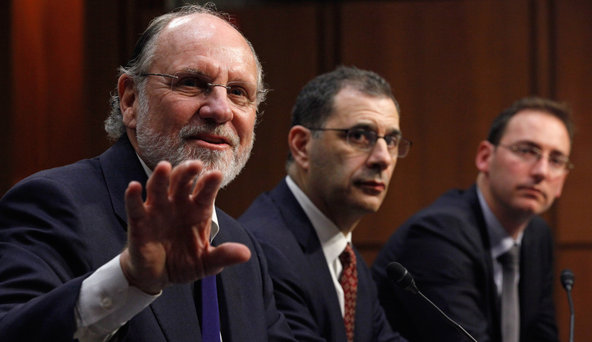

Chip Somodevilla/Getty ImagesFrom left, Jon S. Corzine, MF Global’s former chief executive; Bradley Abelow, the chief operating officer, and Henri Steenkamp, the chief financial officer, testifying before the Senate Agriculture Committee on Tuesday.

Chip Somodevilla/Getty ImagesFrom left, Jon S. Corzine, MF Global’s former chief executive; Bradley Abelow, the chief operating officer, and Henri Steenkamp, the chief financial officer, testifying before the Senate Agriculture Committee on Tuesday. Andrew Harrer/Bloomberg NewsTerrence Duffy, executive chairman of the CME Group, appeared to contradict Jon S. Corzine, MF Global’s former chief, on money transfers before the firm’s collapse.

Andrew Harrer/Bloomberg NewsTerrence Duffy, executive chairman of the CME Group, appeared to contradict Jon S. Corzine, MF Global’s former chief, on money transfers before the firm’s collapse.

WASHINGTON — A Senate hearing into the collapse of MF Global was thrown into confusion on Tuesday after a main witness implied that Jon S. Corzine, its former chief executive, knew the firm had been misusing customer funds, an accusation that could not be substantiated.

Terrence A. Duffy, executive chairman of the CME Group, told lawmakers that MF Global had used $175 million in customer funds to lend from one arm of the firm to another — an assertion that, on its face, may not be illegal — and that Mr. Corzine had known about it.

Later, however, Mr. Duffy accused the firm of improperly transferring customer money, without specifying whether MF Global’s chief executive had known of those transactions.

“Mr. Corzine was aware of the loans being made,” Mr. Duffy told the Senate Agriculture Committee, adding that MF Global had submitted documents to CME, the major exchange where MF Global did business, that kept “regulators in the dark.”

Mr. Duffy’s words, at first, appeared to contradict Mr. Corzine’s earlier testimony before Congress. On Tuesday, Mr. Corzine told the Senate panel that he had not been aware of missing customer money until the late evening of Oct. 30, shortly before the firm filed for bankruptcy. Mr. Duffy suggested that Mr. Corzine had been briefed on the transfers hours or days before.

At the time, futures brokerage firms like MF Global could legitimately use customer money to lend between divisions — if they put a placeholder security in place of the customer cash.

And on Tuesday, Mr. Corzine did say that he had been aware that MF Global occasionally borrowed from customers while putting Treasury securities in the place of client cash. Such borrowing was permitted.

A spokesman for Mr. Corzine declined to comment.

“You raised a serious allegation about what Mr. Corzine may have known,” Senator Debbie Stabenow, a Michigan Democrat who is chairwoman of the committee, said to Mr. Duffy. He did not dispute her statement.

A spokeswoman for the CME Group, one of MF Global’s many regulators, declined to elaborate later on Mr. Duffy’s statement.

The confusion stemming from Mr. Duffy’s testimony comes as the exchange faces questions about its oversight of MF Global. CME was charged with policing the firm, a job that some wronged MF Global customers say it failed to do.

The exact source of Mr. Duffy’s information was also unclear. He said he had been relying on reports from one of his lawyers, who learned of the details from a lower-level CME auditor, who had spoken with an MF Global employee. The unidentified MF Global employee indicated that Mr. Corzine had known MF Global used customer funds to lend to itself.

The testimony caught lawmakers off guard. Mr. Duffy said he had learned about the loans over the weekend, although he failed to include any mention of the transfers in his prepared remarks for the hearing.

Instead, he abruptly inserted the allegations about Mr. Corzine into his opening statement before the committee. Mr. Duffy spoke just minutes after Mr. Corzine left the hearing room following his testimony, leaving Mr. Corzine no opportunity to defend himself before the panel.

“You have sort of tossed a bomb here,” said Senator Pat Roberts of Kansas, the committee’s ranking Republican. “We probably should have had you on first.”

CME, Mr. Duffy told the lawmakers, had referred its information to the Justice Department, which is investigating some $1.2 billion in customer funds that vanished from MF Global during the firm’s dying days.

Aside from Mr. Duffy’s revelation, the hearing Tuesday offered few insights that Mr. Corzine himself had not already given in earlier testimony. But this time, the lack of answers also involved Mr. Corzine’s top deputies at MF Global, Bradley Abelow, the chief operating officer, and Henri Steenkamp, the firm’s chief financial officer.

Senators often appeared frustrated with the lack of answers about where the money had gone and who had been responsible for its disappearance.

Mr. Roberts wondered aloud whom the committee would have to call on to get some answers, suggesting it might even require a PowerPoint presentation and testimony from the firm’s custodian.

Mr. Corzine sought to make two things clear on Tuesday: that he had not directly or indirectly intended to authorize misuse of customer money and that he needed documents to know what happened when.

“I never gave any instructions to misuse customer money, never intended to give any instructions or authority to misuse customer funds, and I find it very hard to understand how anyone could misconstrue what I’ve said as a way to misuse customer money,” he said during questioning.

Asked about when the transfers of customer money might have started, Mr. Corzine declined to speculate, saying only, “I literally would have to go back through thousands of pages.”

While Mr. Corzine drew most of the attention, his deputies were also subjected to the questions of skeptical lawmakers, some of whom have constituents who are bearing the brunt of the MF Global collapse.

Many farmers, grain elevator operators and others in the food industry have their cash trapped at MF Global. Four of them testified before the committee earlier in the day.

None of the three executives offered any insight as to the whereabouts of the money or even how it might have gone missing. They were repeatedly pressed to offer names of MF Global employees who would have been charged with safeguarding customer money.

Senator Mike Johanns, Republican of Nebraska, pressed the firm’s chief financial officer.

“Mr. Steenkamp, I’ve been watching your body language and you seem like the odd man out,” he told the executive, who had been questioned notably less than his two co-panelists. “Do you realize how incredible your testimony sounds to this committee?”

“I wish I could …” Mr. Steenkamp, clearly uncomfortable, began before tapering off.

Mr. Johanns then asked Mr. Steenkamp who was responsible if not the chief financial officer.

“In MF Global Inc., my understanding is that there were numerous controls in place,” Mr. Steenkamp said.

“I want names,” Mr. Johanns boomed. “Who would authorize and who would have that oversight?”

Mr. Steenkamp paused for a long moment. “I don’t think anyone would have the authorization” to misuse customer funds, he replied.

“You’re dancing around with me,” the senator fired back. “I want a name.”

“I’m not trying to dance around the issue,” Mr. Steenkamp replied. “I am not 100 percent sure who the exact person is.”

Ben Protess reported from Washington and Azam Ahmed from New York.

Article source: http://feeds.nytimes.com/click.phdo?i=c529435e21caa816b4aacbc0ddfbd0a4