Bruce Bartlett held senior policy roles in the Reagan and George H.W. Bush administrations and served on the staffs of Representatives Jack Kemp and Ron Paul. He is the author of “The Benefit and the Burden: Tax Reform – Why We Need It and What It Will Take.”

Many years ago, I was talking to Jack Kemp, for whom I worked in the 1970s. He told me that just before George H.W. Bush signed into law the 1990 tax increase, which Kemp strenuously opposed, he made an appointment to see Bush and made a last-ditch effort to get him to reject the legislation. Kemp was then serving as secretary of housing and urban development.

Today’s Economist

Perspectives from expert contributors.

Kemp told me that Bush told him the legislation would stimulate the economy, which was then suffering from a recession that began in July 1990. The expansion of the 1980s, Bush said, didn’t begin until Ronald Reagan signed the Tax Equity and Fiscal Responsibility Act of 1982. Kemp was incredulous.

Tefra, as the Reagan tax increase was called, remains the largest peacetime tax increase in American history. Kemp, despite his love for Reagan, opposed it in Congress, asserting that it would tank the economy, which was still in recession.

I laughed when Kemp told me his Bush story, because that was what he expected me to do. But in the back of my mind, I thought Bush was right.

The economic recovery did begin almost exactly when Tefra took effect.

I recalled this incident last week when the stock market rose sharply after the passage of the tax deal, which raised the top income tax rate and the rate on capital gains and dividends. This is the opposite of what should have happened according to Republican doctrine, which holds that the tiniest increase in tax rates, especially on the rich, is economically devastating.

That got me thinking about the impact of other tax increases in history. A little research showed that sharp increases in the stock market have often followed big tax increases.

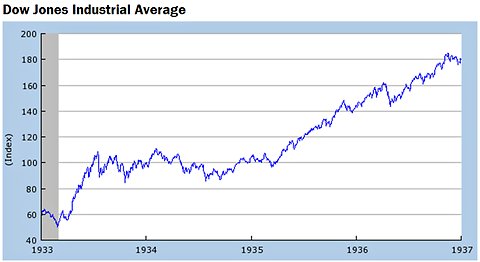

For example, in 1932 Herbert Hoover enacted a large tax increase to stabilize federal finances devastated by the Great Depression, which began in 1929. Among other things, the 1932 tax increase raised the top federal income tax rate to 63 percent from 25 percent. But the Dow Jones industrial average increased sharply in 1933, rising 69 percent.

The Dow remained flat for the next several years and then took a sharp jump beginning in 1935. Intriguingly, 1935 just happens to be the year Franklin D. Roosevelt rammed a big tax increase on the rich through Congress. In his message to Congress on June 19, 1935, he emphasized that no wealthy person became wealthy alone, but only in cooperation with many others:

Wealth in the modern world does not come merely from individual effort; it results from a combination of individual effort and of the manifold uses to which the community puts that effort.

The top federal income tax rate rose to 79 percent beginning in 1936, from 63 percent. Yet the Dow was up 48 percent in 1935 and another 25 percent in 1936.

Anyone following standard supply-side advice would have sold everything the day Roosevelt sent his message to Congress. But anyone buying that day would have made 50 percent on their money by the end of 1936 if they did as well as the Dow.

Federal Reserve Bank of St. Louis, 2013 Shaded area indicates a recession in the United States.

Federal Reserve Bank of St. Louis, 2013 Shaded area indicates a recession in the United States.

World War II led to further tax increases. The really big one came in 1942 and raised revenues by 70 percent, 5 percent of the gross domestic product. The Revenue Act of 1942 was the largest tax increase in American history.

Someone following supply-side theory would undoubtedly have anticipated a stock market crash from such a large tax increase. In fact, an enormous boom followed, despite further large tax increases in 1943, including the institution of tax withholding. From early 1942 through the end of 1945, the Dow doubled, and a supply-sider would have lost out on one of the great bull markets in history.

Fast forward to 1982. Tefra passed the House and Senate on Aug. 19; the Dow closed at 838.57. By the end of the year, it was up to 1,075.70, an increase of 28 percent. The market continued to rise through 1983, closing at 1,258.64.

Bush signed the 1990 budget deal on Nov. 5 of that year, and the Dow closed at 2,502.23. By the end of 1992, the Dow was up 32 percent. Anyone following supply-side theory would have missed yet another bull market.

As most adults are old enough to remember, the 1993 tax increase, which was opposed by every Republican in Congress on the grounds that it would devastate the economy, initiated one of the greatest bull markets in history.

The 1993 legislation raised the top federal income tax rate to 39.6 percent from 31 percent – a huge destruction of incentives for the wealthy,

according to Republican doctrine. It was signed into law on Aug. 10 of that year and the Dow closed at 3,572.73. But by the end of 1993, it was up to 3,754.09, and by the end of 1996 had risen to 6,448.26, a three-year increase of 72 percent.

According to Republican legend, the market didn’t take off until Republicans in Congress cut the capital gains tax in 1997. While much of the bull market did come after 1997, there is no denying that Republican predictions about the effect of the 1993 tax increase were dead wrong.

I’m not going to pretend that tax increases always lead to bull markets or that tax cuts have no effect. I’m saying only that the relationship between taxes, on the one hand, and the economy and the stock market, on the other, is vastly more complex than simplistic Republican dogma would have us believe.

Clearly, there are times when a tax increase sets in motion positive economic forces, like deficit reduction or a more expansionary monetary policy by the Federal Reserve, that overwhelm whatever negative effects may result from higher taxes. The precise impact can only be determined by careful analysis unencumbered by dogmatic beliefs not anchored in empirical results.

Insofar as taxes affect the market, I have long suspected that when tax rates are low they make it too easy for investors to get an adequate after-tax return. When rates rise, they must work harder for a higher before-tax return to compensate for the higher taxes. This pushes money into growth sectors.

I’m not prepared to predict that the great bull market of the 2010s began on Jan. 2. But I do know that anyone who thinks tax increases never precede a bull market is wrong. History proves that.

Article source: http://economix.blogs.nytimes.com/2013/01/08/tax-increases-and-bull-markets/?partner=rss&emc=rss