Simon Johnson, former chief economist of the International Monetary Fund, is the Ronald A. Kurtz Professor of Entrepreneurship at the M.I.T. Sloan School of Management and co-author of “White House Burning: The Founding Fathers, Our National Debt, and Why It Matters to You.”

Congressional Republicans are again threatening not to increase the ceiling on the amount of federal government debt that can be issued. On Wednesday, they agreed to postpone this particular piece of the fiscal confrontation, but only until May. The decision to turn the debt ceiling into a confrontation is a big mistake for the Republicans and extending the indecision is likely to prolong the agony of uncertainty and have damaging economic consequences for the country.

Today’s Economist

Perspectives from expert contributors.

I made these points at a hearing on Tuesday of the House Ways and Means Committee, but unfortunately the Republican majority seems determined to persevere with its destabilizing strategy. (The hearing can be viewed on C-Span’s Web site; see the playlist on the right.)

In most countries, decisions about government spending and revenue bring with them an implied, even automatic decision about how much debt to issue. Spending minus revenue in a year gives you the annual deficit (a flow), while government debt is a stock of obligations outstanding.

Think of it as a bathtub. Spending is water coming in from the tap, and revenue is water leaving through the drain. If there is more spending relative to revenue, there is more water in the bathtub – and the amount of water is the debt.

In the United States, for odd historical reasons, Congress makes two separate decisions, one on the flow (spending and revenue) and the other on the stock (the allowed limit on the debt, known as the debt ceiling).

But once you have decided on the rate of flow into and out of the bathtub, the stock at any given moment is a given. So what happens if Congress suddenly decides that there should be a cap on the water in the bathtub, without altering the flow in or out?

To complicate matters, keep in mind that some of these fiscal flows have already been committed, for example, in terms of interest payments due on existing debt, salaries for active military personnel and Social Security payments. You cannot suddenly grab more revenue out of thin air.

The main problem is that no one knows what would happen if the federal debt were to hit its legal ceiling.

Would the government be forced to default on some obligations to bondholders? Would there be some other form of default — for example, in terms of nonpayment for goods and services already contracted? Or would there just be complete chaos in our fiscal affairs, a throwback to the mid-1780s, before the Constitutional Convention in Philadelphia and before Alexander Hamilton took the public debt firmly in hand?

In the past, the potential for confusion around binding debt-ceiling limits was well understood. The debt ceiling was therefore raised without too much fuss, and the party in opposition would typically object in principle but not put up a real fight. Plenty of other ways are available for Congress to affect revenue and spending (the flow) without throwing everything into disarray by insisting on a stock of debt that is inconsistent with previous commitments.

This changed in summer 2011 when some Republicans decided to dig in behind the idea that they could force the federal government to default if they did not get what they wanted. For some, this was about forcing big spending reductions. For others, federal government default was actually the goal; see this commentary from July 22, 2011, by Ron Paul, a Tea Party favorite who was a member of Congress at the time. (His son, Senator Rand Paul of Kentucky, is currently opposed to increasing the debt ceiling, even on a temporary basis as agreed this week.)

In summer 2011, I warned about the effects of this confrontation over the debt ceiling, contending that it would create a great deal of uncertainty and slow the economic recovery. I particularly stressed the damage that would be done to the private sector — exactly contrary to what the House Republicans asserted they wanted. I also testified to this effect before the Ways and Means Committee on July 26, 2011, although I cannot say my arguments had any impact on Republican thinking.

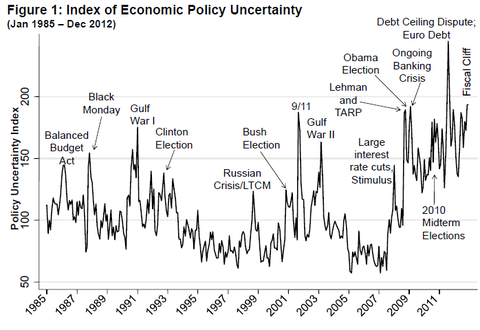

Recent research by Scott Baker and Nicholas Bloom of Stanford and Steven Davis of the University of Chicago looks carefully at what has generated uncertainty about policy over the last 25 years or so. Their Web site is a must-read, as is the latest version of their paper on the topic (updated Jan. 1). This chart from their paper was a main point in my five minutes of opening verbal testimony.

Scott Baker, Nicholas Bloom and Steven Davis This index is composed of four series of data, weighted so that 50 percent is from news articles containing the terms uncertain or uncertainty and economic or economy and policy relevant terms, and 16.63 percent each from the number of tax laws expiring in coming years, a composite of ranges for quarterly forecasts of federal, state and local government expenditures, and a one-year consumer price index from the Federal Reserve Bank of Philadelphia.

Scott Baker, Nicholas Bloom and Steven Davis This index is composed of four series of data, weighted so that 50 percent is from news articles containing the terms uncertain or uncertainty and economic or economy and policy relevant terms, and 16.63 percent each from the number of tax laws expiring in coming years, a composite of ranges for quarterly forecasts of federal, state and local government expenditures, and a one-year consumer price index from the Federal Reserve Bank of Philadelphia.

They find that while the financial crisis of 2008 and its aftermath greatly elevated policy uncertainty in general, the debt-ceiling confrontation in summer 2011 produced the highest level of uncertainty since 1985, when their analysis begins.

Uncertainty about policy creates doubts in the minds of people about what is going to happen to the economy. The natural response in the face of heightened uncertainty is to delay making decisions — people do not go on vacation or buy a car, and business owners and companies do not hire people unless they absolutely need them.

Slap everyone in the face with such concerns after a big financial crisis and you get a slower economic recovery and fewer jobs.

Most economists would say there is no chance that the United States would ever default; this would be an act of collective insanity far in excess of anything ever seen in this country or anywhere in the world. But what really matters is not the view of analysts and commentators. The real issue is whether decision makers throughout the economy think that default or some other disruptive event could occur.

The evidence from Professors Baker, Bloom and Davis is clear. The debt-ceiling fight in summer 2011 made people more uncertain about what was to come.

This is consistent with the fact that August 2011 was a very weak month for job creation. According to the Government Accountability Office, this political confrontation also pushed up the cost of borrowing for the government. And uncertainty of this kind increases risk premiums around the world, because investors want to be compensated for higher risks. This put more pressure on European sovereign debt at an inopportune moment, pushing up yields across the troubled euro zone (including, but not limited to Greece).

In the hearing this week, the Republican line was that the debt ceiling offered a “forcing moment.” This is plainly a threat; otherwise there is no sense in which it is “forcing.” What is the threat? No one knows; even the three Republican witnesses could not agree on what would happen if the debt ceiling were breached.

The threat lies between some form of default and some other form of unprecedented disruption to public finances. Expect uncertainty — perhaps at the level of August 2011, perhaps even higher.

This is an irresponsible way to run fiscal policy. As Representative Sander Levin of Michigan, the senior Democrat on the Ways and Means Committee, put it: “House Republicans continue to play with economic fire. They are playing political games and that undermines certainty.”

The Republicans should take the debt ceiling off the table.

Article source: http://economix.blogs.nytimes.com/2013/01/24/the-debt-ceiling-and-playing-with-fire/?partner=rss&emc=rss