Courtesy Simple

Courtesy Simple

How cool do you want your bank account to look?

That’s what I wondered, as I read about a new feature available to customers of Simple, the new banklike financial service. The service was recently profiled in The New York Times by Jenna Wortham.

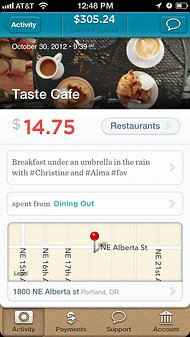

Simple, which depends heavily on smartphones for access, set out to be the anti-bank, with a no fee pledge and easy-to-use features. (The start-up has about 20,000 users; you must be invited to participate.) The latest tweak allows users to upload photographs and attach them to transactions. So, for instance, you can see not only that you spent $200 on your anniversary dinner, but also exactly how enticing that lobster looked.

Right now, you must access the account online to attach a photo. But soon, Simple’s mobile app will let you snap the photo and attach it right away. The idea is to make banking more, well, fun. “Attach a movie poster to your ticket purchase, or album art to a music purchase,” says a description of the new feature on Simple’s Web site. “It just looks cool!”

Simple gets credit for trying something new. But do most people really want their bank account to look “cool”? Or do they just want it to be safe, easy to use and relatively inexpensive?

Josh Reich, Simple’s chief executive, explained that the photo feature originally began as a way to add receipts to transactions, making it easier to track business expenses. But it has morphed into a way to keep track of nonexpense items and to “humanize” your finances, he said.

I can see the attraction. Sort of. Viewing a photo of a gift you bought while on vacation, for instance — which Mr. Reich said he recently added to his account — might help make the task of paying the bill for the trip less painful. And perhaps making banking more fun will encourage users to pay more attention to their finances and think about handling them in more creative ways.

And, of course, the addition of photos is entirely optional.

Would you like to add photos to your online bank records? What sort of transactions would you illustrate?

Article source: http://bucks.blogs.nytimes.com/2013/01/23/your-finances-illustrated-with-photos/?partner=rss&emc=rss