Economists are not very good at predicting crises, but the problem is generally an absence of warnings. It’s not easy to anticipate which low-probability catastrophe will end up happening.

That clearly won’t be the problem if the United States has a debt crisis. Here we have the opposite phenomenon: a possible crisis that economists love to predict.

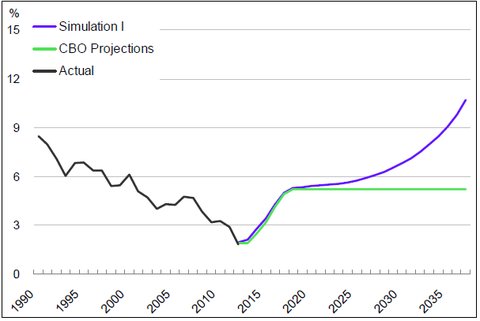

The chart below, from a paper presented Friday morning at the U.S. Monetary Policy Forum in New York, shows one such warning. The green line, labeled CBO Projections, shows the relatively sanguine expectation of the Congressional Budget Office about the average interest rate that investors will demand on federal debt as the debt rises in coming decades.

The purple, upwardly mobile line shows the average interest rate that the authors project that investors will demand. Suffice it to say that such an outcome is unsustainable.

Sources: Haver Analytics, Congressional Budget Office and authors’ calculations Actual and projected 10-year bond yields under Congressional Budget Office assumptions and baseline simulations of the authors. From “Crunch Time: Fiscal Crises and the Role of Monetary Policy,” by David Greenlaw, James D. Hamilton, Peter Hooper and Frederic S. Mishkin.

Sources: Haver Analytics, Congressional Budget Office and authors’ calculations Actual and projected 10-year bond yields under Congressional Budget Office assumptions and baseline simulations of the authors. From “Crunch Time: Fiscal Crises and the Role of Monetary Policy,” by David Greenlaw, James D. Hamilton, Peter Hooper and Frederic S. Mishkin.

The authors, two professors and two market economists, compared interest rates on the sovereign debt of 20 developed nations with the size of those debts in comparison to their gross domestic product, and with each nation’s current-account surpluses or deficits.

The headline conclusion: A one-percentage-point increase in debt as a share of gross domestic product increases 10-year borrowing costs by 4.5 basis points. That means an additional $450,000 in annual interest payments on every $1 billion in debt.

Secondly, a one-percentage-point increase in the current-account deficit raises borrowing costs by 18 basis points, or $1.8 million in interest on every $1 billion in debt.

Third, the penalties increase at higher debt levels, and the increases are not linear. In other words, debt levels can cross thresholds that lead investors to demand significantly higher interest rates, and once that kind of cycle begins, it can be very hard to escape.

Where is the line? “Countries with debt above 80 percent of G.D.P. and persistent current-account deficits are vulnerable to a rapid fiscal deterioration as a result of these tipping-point dynamics,” write David Greenlaw, an economist at Morgan Stanley; James D. Hamilton, a professor at the University of California, San Diego; Peter Hooper, an economist at Deutsche Bank Securities; and Frederic S. Mishkin, a professor at Columbia University. The paper was presented at a conference convened by the University of Chicago Booth School of Business.

This is bad news for the United States because, as it happens, the national debt is 80 percent of annual economic output, the nation has a persistent current-account deficit, and it is planning to significantly increase the scale of borrowing, relative to output, in coming decades.

A host of other studies have reached similar conclusions. The estimated thresholds range from about 60 percent to 120 percent, but the bottom line is always the same: the federal debt cannot continue to grow relative to the size of the economy, or else investors will start demanding much higher interest rates and the United States will fall into crisis.

“We should be scared,” said Professor Mishkin, a former Federal Reserve governor. “Something needs to be done,” he added, although he acknowledged there was no sign of crisis just yet.

This is undoubtedly true in an absolute sense. But there are reasons to doubt the basic premise that the history of other nations can tell us how close we are to the cliff.

The problem with every attempt to look for debt limit thresholds has a name, and that name is Japan, a country that is able to borrow at one of the lowest average interest rates of any developed country despite a debt burden that is the largest, relative to its economic output, of any developed country. Nor is this an ephemeral anomaly. It has been true for years.

Japan’s debts total about 230 percent of its annual output, and so far, investors don’t mind.

In part, the authors address this in the traditional manner, by lopping off 5 percent of their 20-nation sample and simply declaring, “There is something very special about Japan.”

This is quite possibly true. But because there are not very many developed countries — in this study Japan is just one of 20 — it also might cause a reader to wonder about the universality of any rules derived from the remaining 19 cases, particularly since half of the remaining sample share a currency and an economic union. They are not exactly independent variables.

Furthermore, it’s quite possible that the United States also is something of a special case.

Which brings us to the more important acknowledgment, buried deep in the paper: 80 percent is not a magic number. It’s not even a particularly good summary of past experience. Rather, it’s an average of widely divergent experiences. And it doesn’t necessarily tell us much more than common sense: countries with more debt run greater risks of losing the confidence of investors, and have less flexibility to deal with new economic problems.

“We don’t know where the tipping point is,” Jerome H. Powell, a Federal Reserve governor, said in a response to the paper. But, he continued, “Wherever it is, we’re getting closer to it.”

Article source: http://economix.blogs.nytimes.com/2013/02/22/predicting-a-crisis-repeatedly/?partner=rss&emc=rss