The retailer on Wednesday lowered its annual profit forecast after reporting a 13 percent drop in second-quarter profit, as its expansion into Canada — its first foray outside the United States — has proved more challenging than it previously thought.

But the company is also contending with mixed economic signals that have caused it and its rivals, like Walmart and Macy’s, to temper their forecasts for the remainder of the year. While jobs are easier to obtain and the housing market is gaining momentum, these improvements have not been enough to persuade most Americans, who are facing stagnant wage growth, to spend more freely.

“As we monitor the economy and consumer sentiment, we continue to see a mix of signals in which emerging optimism is balanced with continuing challenges,” Gregg W. Steinhafel, Target’s chairman, president and chief executive, said on an earnings call with investors.

Target earned $611 million, or 95 cents a share, in the quarter ending Aug. 3, compared with $704 million, or $1.06 a share, in the period a year earlier.

Excluding certain items related to its expansion into Canada, the retailer earned $1.19 a share.

Total revenue reached $17.12 billion, up 2 percent from $16.78 billion a year ago. Analysts had expected earnings of 96 cents a share on revenue of $17.28 billion, according to FactSet.

Revenue at stores open at least a year — a gauge of a retailer’s health — rose 1.2 percent. That was below the 1.9 percent analysts had expected. Its shares fell 3.6 percent on Wednesday, or $2.45, to $65.50.

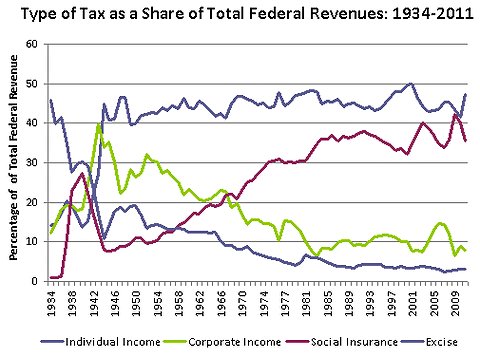

Like Walmart, Target said that its customers continued to struggle with a 2 percentage-point increase in the Social Security payroll tax since Jan. 1. That means take-home pay for a household earning $50,000 a year has been cut by $1,000.

For the full year, Target now expects earnings per share to be at the low end of its previous guidance of $4.70 to $4.90. Target said that it expected its costs related to its Canadian expansion will depress earnings by 82 cents, up from its projected 45 cents a share. In May, the company trimmed its projections from the original outlook of $4.85 a share to $5.05, citing cautious shoppers. Analysts expect $4.29 a share for the full year.

Article source: http://www.nytimes.com/2013/08/22/business/profit-falls-13-at-target-and-it-lowers-expectations.html?partner=rss&emc=rss