CATHERINE RAMPELL

Dollars to doughnuts.

The one bright spot in Wednesday’s dim gross domestic product report was a large jump in household income, welcome news given that incomes have been relatively flat in recent months after falling sharply in the previous few years.

As was confirmed Thursday in a release on December personal income, though, the boost to consumers’ pocketbooks is likely to be short-lived.

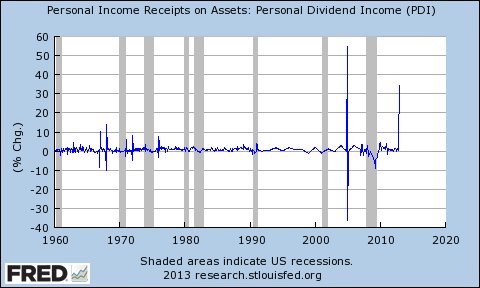

Most of the 2.6 percent increase in incomes last month involved companies that accelerated dividends, bonuses and other payments into 2012 before higher tax rates kicked in for 2013. Personal dividend income, for example, rose at a seasonally adjusted monthly rate of 34.3 percent in December versus 4.5 percent in November.

That’s the second-fastest monthly personal dividend income growth on record, after a huge spike of 54.8 percent in December 2004 (when Microsoft threw the whole trend out of whack by offering a one-time special dividend totaling $32 billion):

The Bureau of Economic Analysis estimated that in the quarter companies paid special or accelerated dividends of $39.5 billion, of which $26.4 billion was paid to individuals and so is included in personal income. The bureau also estimated that accelerated bonuses and “other types of irregular pay” probably gave a one-time boost to wages and salaries in the quarter totaling about $3.75 billion (or $15 billion at an annual rate).

We’ll almost certainly see a payback for that accelerated income last month in the form of lower dividend and bonus payments early this year. Additionally, households will be receiving less in their employee paychecks this month than they did last year because payroll taxes rose at the start of 2013.

None of this is good for consumer spending.

On the bright side, though, the sell-off of various kinds of assets in December will probably be good for the government’s coffers.

As my colleague Floyd Norris has written, the increase in tax rates in 2013 will likely result in higher tax receipts (and a lower budget deficit) for the current fiscal year than would have otherwise been expected.

Article source: http://economix.blogs.nytimes.com/2013/01/31/staying-ahead-of-the-tax-man/?partner=rss&emc=rss