Bruce Bartlett held senior policy roles in the Reagan and George H.W. Bush administrations and served on the staffs of Representatives Jack Kemp and Ron Paul. He is the author of “The Benefit and the Burden: Tax Reform – Why We Need It and What It Will Take.”

Two things I’ve heard my whole life that always seem within reach but have never occurred are that we will move to paperless offices and a cashless society. In theory, it seems simple enough; computers and the Internet should obviate the need for paper, and credit and debit cards and electronic bill pay should make cash superfluous.

Today’s Economist

Perspectives from expert contributors.

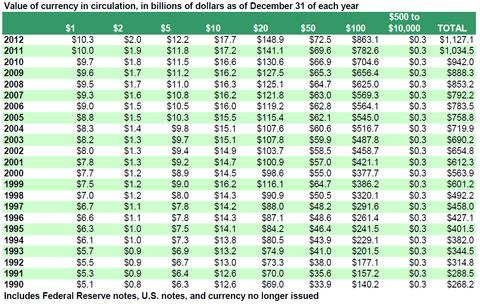

However, as we all know, we are no closer to a paperless office than we were at the dawn of the computer era. Same goes for the cashless society. As a new report from the Federal Reserve Bank of San Francisco explains, cash has not only held its own against competitors but continues to grow in popularity. Measured in dollar terms, there is 42 percent more cash in circulation today than five years ago.

Among the reasons for the rise in cash holdings are convenience, dependability and anonymity. Another key factor is the decline in interest rates, which has reduced the opportunity cost of holding cash relative to such interest-earning assets as bank deposits, money market funds and Treasury bills.

Many economists believe that the rise in cash is strongly related to growth in the so-called underground economy – criminal activity such as drug dealing, as well as tax evasion by people working off the books for cash. Strong evidence for this proposition comes from examining the distribution of cash holdings by denomination.

Federal Reserve Board

Federal Reserve Board

As one can see, 84 percent of the increase in cash since 1990 has been in the form of $100 bills, which have risen to 77 percent of the value of cash outstanding in 2012 from 52 percent in 1990.

I seldom use $100 bills for anything except Christmas gifts to nieces and nephews, nor do I ever see people use them in stores. I suspect that most people have the same experience. For large purchases, most law-abiding people use checks or credit cards.

Studies and common sense suggest that those people most likely to use large bills are doing so for nefarious purposes, especially drug dealing. One can easily fit $1 million in $100 bills into a briefcase.

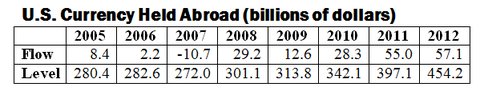

Another key factor has been the rising amount of United States currency being exported. The Federal Reserve estimates the annual flow of United States currency abroad as well as the total level of such currency, which is counted in the aggregate currency figures in the table above. (These data appear on Line 25 in Tables F.204 and L.204 in the Fed’s Z.1 flow of funds release.)

Federal Reserve

Federal Reserve

One consequence of the rising share of United States currency held abroad is that it may distort analyses of the relationship between the money supply and economic activity. Many economists believe that inflation results largely, if not exclusively, from an increase in the money supply, much of which consists of currency, the rest being bank deposits, travelers checks and other forms of money.

But if much of the money supply circulates abroad, then any analysis correlating the money supply to domestic economic activity may be distorted and provide false conclusions.

Incidentally, exports of cash appear in the Commerce Department’s data on international transactions (Line 67). It is recorded as an increase in foreign-owned assets in the United States, but is better thought of as an almost costless way of financing a good chunk of our current account deficit. It’s like borrowing money from foreigners that most likely will never have to be paid back, at zero interest.

Foreigners hold United States currency for the same reasons Americans do and may have better motives for doing so, especially in countries suffering severe financial problems such as Cyprus and Greece. Moreover, the continuing economic crisis in Europe has diminished the popularity of the euro even though it has the advantage of coming in 500-euro denominations, about $645 at current exchange rates, making it more compact and convenient for large cash transactions.

However, some countries have withdrawn those notes as a crime-fighting measure, which has probably raised the popularity of the good old $100 bill. (United States $500 and larger bills are no longer produced and are withdrawn when found.)

According to a Federal Reserve study, the vast bulk of United States currency held abroad is $100 bills. Indeed, 65 percent of all $100 bills in existence circulate outside the United States.

Article source: http://economix.blogs.nytimes.com/2013/04/09/americas-most-profitable-export-is-cash/?partner=rss&emc=rss