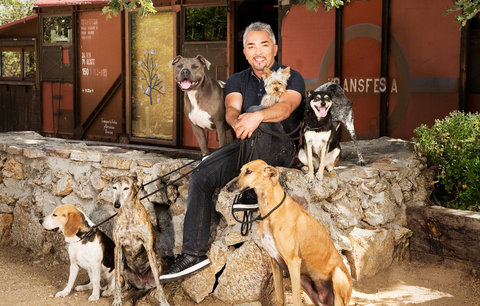

PowWow/National Geographic Wild Cesar Millan, the star of the “Dog Whisperer” television series, is planning an extensive celebrity branding campaign in China.

PowWow/National Geographic Wild Cesar Millan, the star of the “Dog Whisperer” television series, is planning an extensive celebrity branding campaign in China.

It has not always been easy for dogs in China. They have been beaten, eaten and, once, were banned in Beijing.

But China’s rapidly growing pet canine population will soon have a new media hero, in the person of Cesar Millan.

Mr. Millan, known here as the star of the “Dog Whisperer” television series, and soon to be seen in a new show, “Leader of the Pack,” is planning what his advisers describe as one of the first all-out celebrity branding campaigns in China.

It will include broadcasting the new series (which will have its debut here Tuesday on the Nat Geo Wild channel), translations of his books, personal appearances, a new Web site, and, of course, lots of e-commerce, with products like personally branded leashes, collars and treats.

But, most of all, said Mr. Millan, it is a rare chance to shape attitudes in a place where pet dogs are only now coming into their own.

“This is the time for China,” said Mr. Millan, who spoke of his campaign as an educational effort to teach the Chinese “how not to make mistakes other countries have made” with their dogs. Those mistakes, he explained, involve common confusion between loving a dog, and knowing what love really means to a dog.

“If he never made a nickel, Cesar would still want to do this,” said Mr. Millan’s partner in the venture, the China media consultant Rob Cain. But, Mr. Cain added, “He’s not opposed to making money.”

Mr. Cain, who said he and Mr. Millan are seeking additional investors, figures 30 million to 60 million pet dogs live in China. Many of their owners presumably are waiting to go upscale as followers of the world-renowned dog behaviorist and buyers of his products.

The “Dog Whisperer” program is already familiar in China, Mr. Cain noted. But Mr. Millan, he said, is poised to attract an emerging generation of Chinese dog lovers with the coordinated media effort and a tour, which will probably occur early next year. Mr. Millan said he was not daunted by the social and government restrictions that can still make the Chinese media business a challenge for outsiders.

“There are rules, values and limitations,” he said. But, he added: “I love that. That’s what I teach.”

Article source: http://mediadecoder.blogs.nytimes.com/2013/02/17/dog-experts-dos-and-donts-for-pet-owners-in-china/?partner=rss&emc=rss