Bruce Bartlett held senior policy roles in the Reagan and George H.W. Bush administrations and served on the staffs of Representatives Jack Kemp and Ron Paul. He is the author of “The Benefit and the Burden: Tax Reform – Why We Need It and What It Will Take.”

In the 1970s, there was a management fad called “zero-based budgeting” that Jimmy Carter used as governor of Georgia and tried to put in place as president. The theory was that every government program needed to justify itself annually, rather than being automatically renewed.

Today’s Economist

Perspectives from expert contributors.

The idea never caught on because the payoff turned out to be small and it required a great deal of paperwork and data collection that complicated the budget process, according to a recent review by the Government Finance Officers Association.

Now, the chairman and ranking member of the tax-writing Senate Finance Committee, Senators Max Baucus, Democrat of Montana, and Orrin Hatch, Republican of Utah, have proposed zero-based tax reform. Their idea is to wipe out every tax expenditure – deductions, exclusions and credits that reduce tax liability – and start from scratch, requiring tax-expenditure supporters to justify each one as if it were being proposed for the first time. Presumably, tax rates would be reduced, but the proposal does not say how much.

Critically, the senators say they will maintain the existing progressivity of the tax code. This puts a severe constraint on their efforts, because tax expenditures are not evenly distributed across income classes, nor is the burden of taxation. What appears fair at first glance may be grossly unfair when thinking the issue through.

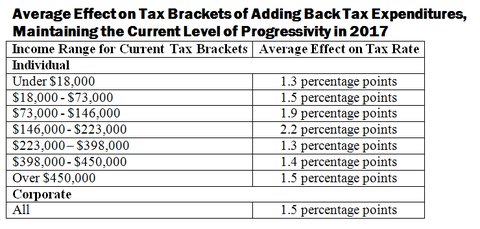

The senators provide the table below to show the impact on average federal income tax rates in 2017 of restoring $2 trillion of individual income tax expenditures and $200 billion of corporate tax expenditures over 10 years.

Senate Finance Committee

Senate Finance Committee

The point seems to be that every income class will be hit approximately the same if Congress retains tax expenditures rather than eliminating them. But that is not at all what it shows, because the baseline on which the tax changes would be applied is not indicated. Also, the brackets are oddly chosen because five of the seven brackets apply to a tiny number of households with incomes far above those of most Americans. To have a clearer idea of what might happen, the following table from the Tax Policy Center shows the distribution of federal taxes in 2017 under current law.

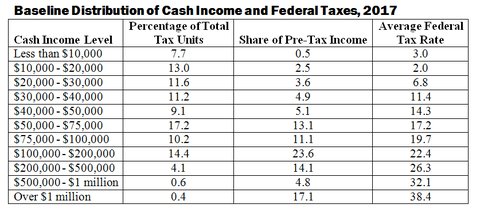

Tax Policy Center Federal taxes include individual and corporate income taxes, payroll and estate taxes.

Tax Policy Center Federal taxes include individual and corporate income taxes, payroll and estate taxes.

It’s hard to compare the two tables because we don’t know what impact tax expenditures have on each income bracket. But clearly, those at the bottom are not going to benefit much, if at all, from rate reductions because they pay little if any federal income taxes. As Republicans keep reminding us, 47 percent of tax filers pay no federal income taxes. It’s disingenuous to imply that a family making $20,000 and one making more than $450,000 will be affected equally by the retention of tax expenditures, as the first table shows.

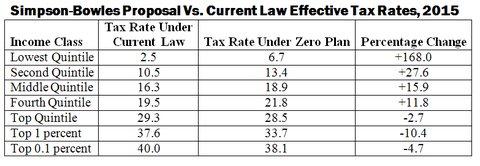

Kitty Richards of the Center for American Progress points to another way of looking at the zero-based proposal. She notes that the budget proposal put forward by Alan Simpson and Erskine Bowles in 2010 would also have wiped the slate clean of all tax expenditures and reduced tax rates to three statutory brackets of 9 percent, 15 percent and 24 percent.

In 2010, the Tax Policy Center estimated the distributional effect of this proposal for 2015, retaining only the child credit, earned income tax credit and employer contributions for health and retirement plans. The following table compares that proposal to the center’s current estimate of federal tax rates in 2015 for each 20 percent of households and the ultra-wealthy.

Tax Policy Center

Tax Policy Center

As one can see, those with lower and middle incomes would see a tax increase, while the wealthy would get a tax cut. That is because those with high incomes control such a large percentage of total income that they benefit disproportionately from any cut in tax rates. It is hard to see how any reduction in tax rates financed by base-broadening won’t have a similar effect given the current distribution of taxes.

Of course, another problem with the Baucus-Hatch approach is that certain tax expenditures are so popular it is inconceivable that they would ever be abolished. As I have previously noted, just the top 10 largest tax expenditures on the individual side account for more than 70 percent of the estimated $1.1 trillion in total tax expenditures. These include such “sacred cows” as the exclusion for health insurance, the deduction for interest on owner-occupied homes, the deduction for charitable contributions and others that Congress will never abolish.

Even special tax breaks that members of both parties denounce and that are clearly perverse have proven impossible to repeal.

The idea that we can wipe the slate clean and start from scratch is ridiculous pie-in-the-sky thinking and an abrogation of responsibility by the Senate’s two principal leaders on tax issues. They ought to be willing to exercise some judgment and put forward a specific proposal of tax expenditures they think are worthy of abolition in order to clean up the tax code and lower rates. That’s what Ronald Reagan did in 1985, which led to enactment of the Tax Reform Act of 1986.

Until a specific proposal on the table can be discussed, analyzed and amended, tax reform isn’t going anywhere. Senators Baucus and Hatch are not helping; they are just wasting time.

Article source: http://economix.blogs.nytimes.com/2013/07/02/zero-based-tax-reform/?partner=rss&emc=rss