PARIS — The world economy will continue slowly expanding for the rest of the year, despite signs of relative weakness in China and other emerging markets, and an uneven recovery in Europe, the Organization for Economic Cooperation and Development said Tuesday.

The United States, Britain and Japan are growing “at encouraging rates,” while the euro zone emerged from six straight quarters of contraction in the April-June period, the organization said in a new forecast. Recent indicators from the major advanced economies, including increased business confidence and stronger industrial production, suggest the trend will “continue at the improved rate seen in the second quarter.”

The United States economy will probably grow at a 2.5 percent annualized rate in the third quarter and 2.7 percent in the fourth, the report said. The country’s economy grew at a 2.5 percent rate in the second quarter.

Japan will grow by 2.6 percent in the third quarter and 2.4 percent in the fourth quarter, in line with the 2.6 percent second quarter figure, according to the organization, a Paris-based research and policy consortium representing the world’s most advanced economies. Its outlook contained no major surprises and appeared to be consistent with mainstream private and official forecasts.

Jorgen Elmeskov, the O.E.C.D.’s deputy chief economist, said the latest indicators point to “essentially the same” picture as in May, the time of the organization’s last assessment, although “the numbers are a tad higher.”

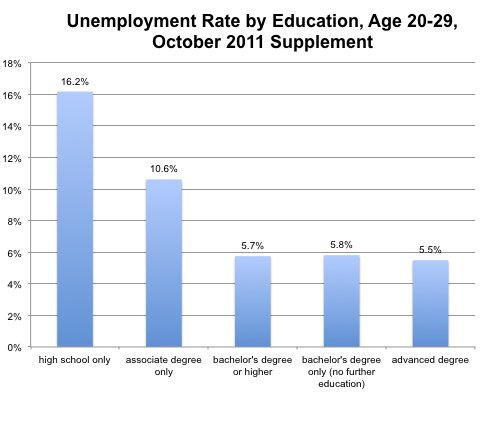

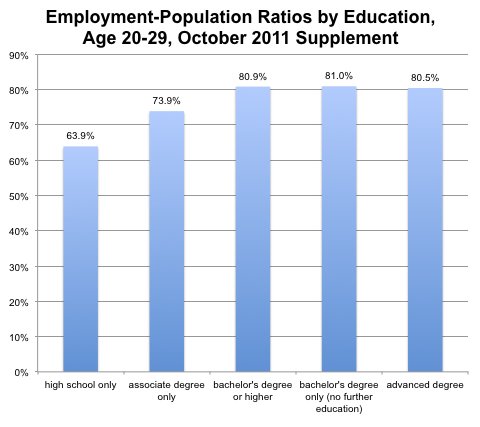

But the assessment of the jobs market was notably somber. Unemployment, currently at high levels across the developed world, could become entrenched, the O.E.C.D. said, as long-term joblessness becomes structural unemployment, with the potential to “remain even as the recovery takes hold.”

Germany, France and Italy, the three largest euro zone economies, are likely to expand by a combined 1.3 percent in the third quarter and 1.4 percent in the fourth quarter, the organization said. That would be a little slower than the second quarter, when growth in those economies was 1.6 percent. Germany’s economy will continue to be the main driver of European growth, the report suggests, even as France grows slowly and Italy continues to contract slightly.

The picture in emerging economies is less promising, the organization noted. China, it said, “appears to have passed the trough” — the nadir of its economic cycle — but it and other emerging economies face significant uncertainty, including possible financial market disruptions. That would be partly in reaction to the United States Federal Reserve’s plans to begin scaling back its economic stimulus program, a process being called “tapering” by the financial world.

The Chinese economy is likely to grow at a 7.2 percent annualized rate in the third quarter and 8.1 percent in the fourth, the report said, accelerating from the 7.0 percent growth recorded in the second quarter.

While China’s overall growth rate is faster than that of developed countries, and the recent cooling partly reflects the government’s desire to rein in credit market excesses, many economists say that high growth is necessary to hold social tensions in check.

In some emerging economies, slowing growth, together with the prospect of tighter Federal Reserve monetary policy and the increase in global bond yields that have accompanied it, have brought “market instability, rising financing costs, capital outflows and currency depreciations,” the report said. The problem is most pronounced where governments have depended on inflows of foreign investment to finance current-account deficits, it noted.

One country facing such a predicament is India, where the currency has been falling sharply. In such a situation, the report said, emerging market central banks might face “difficult policy dilemmas,” with capital flight and downward pressure on currencies arguing for higher interest rates that could in turn weigh on growth.

The renewed momentum of some of the more advanced economies marks a turnabout from recent years, when moribund growth in Japan and Europe was more than balanced by strong growth in emerging markets, the report said. Now, the weaker showing by emerging markets “makes for a continuation of sluggish global growth, notwithstanding the pickup in advanced economies.”

Mr. Elmeskov pointed to “a loss of momentum in structural reform” among emerging market countries as a contributor to the slowing growth,

Under the circumstances, the report cautioned, “a sustainable recovery is not yet firmly established and important risks remain,” among them the possibility of “deadlock and brinkmanship over fiscal policy in the United States,” and the 17-nation euro zone’s continuing vulnerability to “renewed financial, banking and sovereign debt tensions.”

“The risks still call for a determined policy approach,” Mr. Elmeskov said.

Unemployment, currently at high levels across the developed world, could become entrenched, it said, as long-term joblessness becomes structural unemployment, with the potential to “remain even as the recovery takes hold.”

The problem of long-term joblessness is best addressed by better training policies, as well as stronger demand, as well as tax reforms to increase work incentives, the organization said.

Both the developed economies and the emerging countries face the prospect that growth will remain slow over the longer term, it said, so “reforms to boost growth, rebalance the global economy and reduce structural impediments to job creation remain vital.”

Article source: http://www.nytimes.com/2013/09/04/business/global/world-economy-growing-unevenly-oecd-says.html?partner=rss&emc=rss