For jobs, the past four years have been a wash.

FLOYD NORRIS

Notions on high and low finance.

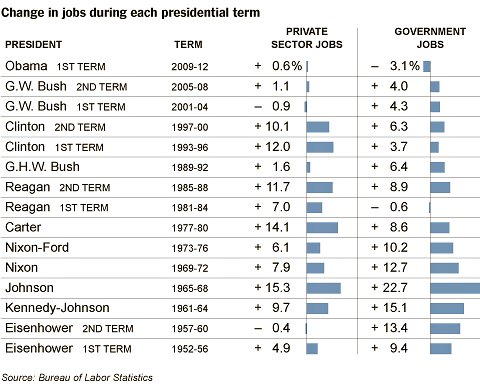

The December jobs figures out today indicate that there were 725,000 more jobs in the private sector than at the end of 2008 — and 697,000 fewer government jobs. That works into a private-sector gain of 0.6 percent, and a government sector decline of 3.1 percent.

In total, the number of people with jobs is up by 28,000, or 0.02 percent.

How does that compare? It is by far the largest four-year decline in government employment since the 1944-48 term. That decline was caused by the end of World War II; this one was caused largely by budget limitations. The only other post-1948 four-year drop was during Ronald Reagan’s first term, when government employment fell 0.6 percent.

Going back to Dwight Eisenhower, there have been only two administrations that turned in a worse performance in private-sector job growth. There were small declines in Eisenhower’s first term and in George W. Bush’s first term. Mr. Bush’s second term posted a scant 1.1 percent gain in private-sector employment — a gain that was wiped out during the first two months of 2009.

Over all, Mr. Obama’s first four years narrowly — and preliminarily — escaped being the second four-year presidential term since World War II to suffer net job losses. The first was George W. Bush’s first term.

The New York Times

The New York Times

A note on methodology. A month from now the Bureau of Labor Statistics will announce the final benchmark revision for the 12 months through March 2012. The preliminary estimate for that revision was that the economy gained 453,000 more private-sector jobs during the period than was previously reported, and lost 67,000 more government jobs. The calculations in this post incorporate those estimates.

The December figure will of course be revised for the next two months, and then will get a final revision in February 2014. Only then will it be clear whether the past four years had a net gain or loss in jobs.

Article source: http://economix.blogs.nytimes.com/2013/01/04/four-years-later-28000-more-jobs/?partner=rss&emc=rss