Carl Richards

Carl Richards

Carl Richards is a financial planner in Park City, Utah, and is the director of investor education at the BAM Alliance. His book, “The Behavior Gap,” was published last year. His sketches are archived on the Bucks blog.

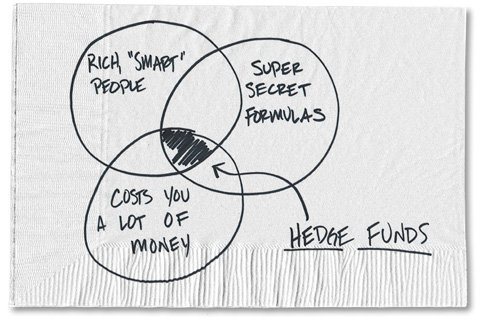

People seem to be sticking with hedge funds, despite another terrible year in a terrible decade of performance, according to The Economist:

“The SP 500 has now outperformed its hedge-fund rival for 10 straight years, with the exception of 2008 when both fell sharply. A simple-minded investment portfolio, 60 percent of it in [stock] shares and the rest in sovereign bonds, has delivered returns of more than 90 percent over the last decade, compared with a meager 17 percent after fees for hedge funds.”

On top of that, investors are paying through the nose for the privilege of investing in hedge funds. Felix Salmon points out:

“Steve Cohen’s SAC Capital, marred by insider trading investigations, made it to the top of Bloomberg Markets’ ranking of the most profitable hedge funds this year, not because of performance but because of fees. Instead of the usual 2 and 20 fee structure, SAC reportedly charges a 3 percent management fee and as much as 50 percent of its clients’ profits.”

The question that I can’t stop asking myself is why?

Why, despite this body of evidence and our experience to the contrary, do people think that once you have a bunch of money you’ve somehow outgrown the simple, low-cost investment tools that most academics think you should use, like broadly diversified index funds and basic, safe fixed-income instruments?

I can think of a few possible reasons.

First, that’s just what rich, smart people do, right? It’s just another piece of (bogus) investing folklore: Once you have a big pile of money to invest, the solution must be complicated. And the more complicated and secretive and exclusive it is, the better.

Second, people want to believe there’s a better way of investing that’s only available to a select few. This idea of using plain old mutual funds is for the common folk. People think, “I’ve got to get access to the best minds in the industry, and they’re in the heads of people who go manage hedge funds, right?”

Finally, there’s a perverse belief that if something is more expensive, it simply has to be better.

But when it comes to investing, as Vanguard Group’s founder, John Bogle said, “You get what you don’t pay for.”

This is just cold, hard math. If an investment earns 10 percent, and you’re paying a 3 percent management fee plus 50 percent of profits (or even 2 and 20), you’re going to keep a lot less of your money than with an investment that earns 10 percent and only charges a management fee of 0.5 percent or 0.25 percent, like an index mutual fund or exchange-traded fund might.

I once worked with an attorney who represented a large family endowment that wanted a new investing strategy. So I walked him through a simple, well-diversified, low-cost portfolio. I gave him the returns and the risk numbers. They were impressive. But this was just a plain vanilla portfolio.

Three other groups made pitches. Those folks came with two-inch-thick proposals and flew people in to give presentations. Their strategies were pretty complicated with lots of bells and whistles. But their performance numbers weren’t quite as good.

Not long after the pitches, the lawyer called to say that his client had decided to go in different direction. He told me it was because my plan seemed too basic.

I knew this attorney pretty well. I waited a few days, and then I took the same numbers from my too-basic portfolio and moved the return number down a little, bumped the risk number up a little and charged a slightly higher fee.

I sent the numbers to the lawyer and called him and said something like, “Hey, did you look at those numbers? The strategy involves a proprietary fund run by some of the smartest people I’ve ever met. They won’t even reveal their process because it’s basically rocket science in a box.”

His response? “Wow, we’d like to hear more about that.”

I’m curious: Why do you think people still invest in hedge funds? What am I missing?

Article source: http://bucks.blogs.nytimes.com/2013/01/22/the-appeal-of-investments-that-cost-more-and-return-less/?partner=rss&emc=rss