CATHERINE RAMPELL

Dollars to doughnuts.

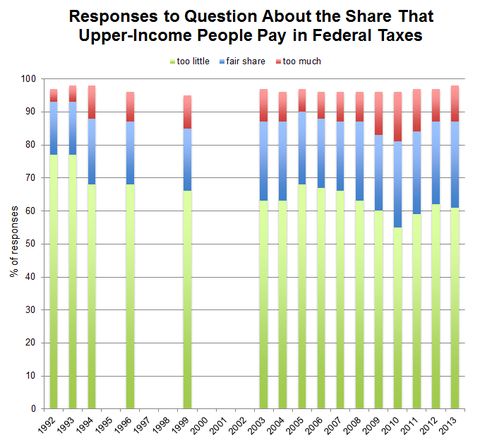

On Tuesday Bruce Bartlett mentioned that a majority of Americans believe that high-income people do not pay enough in taxes. That majority, though, has been shrinking over the last couple of decades, according to new data from Gallup.

Source: Gallup. Latest poll was conducted through telephone interviews April 4-7, 2013, with a random sample of 1,005 adults. The margin of sampling error is plus or minus 4 percentage points. Totals do not sum to 100 percent because some respondents answered “no opinion.”

Source: Gallup. Latest poll was conducted through telephone interviews April 4-7, 2013, with a random sample of 1,005 adults. The margin of sampling error is plus or minus 4 percentage points. Totals do not sum to 100 percent because some respondents answered “no opinion.”

Gallup asks respondents about whether they think members of different income groups are paying “their fair share in federal taxes, paying too much or paying too little.” In 1992 and 1993, 77 percent of Americans said that upper-income people paid too little. Today, the share is 61 percent.

That change in public opinion seems to contradict the trend in the actual tax burden faced by high-income households. As a New York Times data analysis showed last fall, the average tax rate paid by people of all income classes has fallen since the mid-1990s, including that for wealthier people.

That said, the share of the nation’s total tax bill that is paid by the wealthy has been growing — but that’s because the incomes of the wealthy have increased so strikingly, faster than the individual tax rates they face have fallen. And of course Congress did raise the top marginal tax rate for 2013.

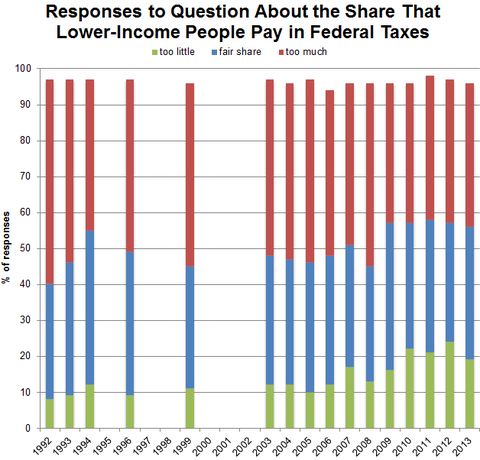

Meanwhile, as I noted last year, Americans have become much more critical of the tax share paid by the poor.

Source: Gallup. Latest poll was conducted through telephone interviews April 4-7, 2013, with a random sample of 1,005 adults. The margin of sampling error is plus or minus 4 percentage points. Totals do not sum to 100 percent because some respondents answered “no opinion.”

Source: Gallup. Latest poll was conducted through telephone interviews April 4-7, 2013, with a random sample of 1,005 adults. The margin of sampling error is plus or minus 4 percentage points. Totals do not sum to 100 percent because some respondents answered “no opinion.”

In 1992, 8 percent of Americans said lower-income people paid too little in taxes. When the question was asked this month, the share was 19 percent, perhaps resonating with the sentiment expressed by Mitt Romney’s “47 percent” comments.

Article source: http://economix.blogs.nytimes.com/2013/04/18/on-whether-the-rich-pay-too-little-in-taxes/?partner=rss&emc=rss