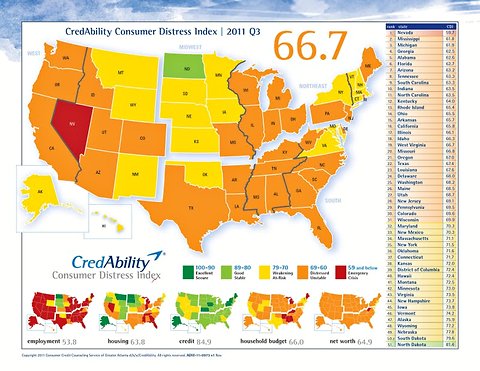

Courtesy of CredAbilityA survey by a consumer counseling agency found that the average consumer in the states shaded red or orange is in financial distress.

Courtesy of CredAbilityA survey by a consumer counseling agency found that the average consumer in the states shaded red or orange is in financial distress.

Continued housing distress and rising prices for food and gas are weighing heavily on American families’ finances as the holiday shopping season begins, a quarterly analysis shows.

The CredAbility Consumer Distress Index, a measure of household financial stability, fell sharply in the third quarter, largely erasing improvements made over the prior three quarters. An uptick in late mortgage and rental payments and higher prices at the grocery store and gas pumps were the chief culprits.

CredAbility, a nonprofit consumer counseling agency based in Atlanta, crunches national data in five different categories — employment, housing, credit, household budget and net worth — to compile the index. A score below 70 indicates financial distress.

In the latest analysis, United States households scored 66.7 on the index’s 100-point scale, a “significant” drop from 69.2 in the second quarter, and the largest drop since the third quarter of 2008, the agency found. The nation’s consumers have now been in financial distress for 12 consecutive quarters, according to the index. (The analysis also measured consumer distress in individual states and found that only 19, as well as the District of Columbia, had scores above 70.)

“The average American family is feeling significant distress,” said Mark Cole, chief operating officer of CredAbility and the index’s author. The unemployment rate hasn’t changed, but the rate of “under-employment,” in which people are working part-time rather than full-time for economic reasons, increased in the quarter.

Despite the gloomy index numbers, indications are that retail sales were up significantly over the bellwether Thanksgiving holiday weekend. Mr. Cole said he did not think that sort of spending could continue, given that the average family has shrinking savings and less left over at the end of the month. People fatigued by living within tight budgets may be looking for bargains, he said, but “It’s hard for me to imaging there’s that much spending power left.”

“The only way those gains are sustainable is if they borrow money,” he said, noting that consumers have been doing better at managing debt. “My hope is they’re not going to borrow money to buy holiday gifts.”

What are your plans for holiday spending? Does your budget allow for gifts, or do you plan to borrow to buy presents?

Article source: http://feeds.nytimes.com/click.phdo?i=25207294c68ddd59451482e7cd0445a4