New jobs data on Friday offered hope for this elusive middle ground in the economy, as the Federal Reserve wrestles with when to ease its stimulus efforts without endangering the recovery and the markets.

The pace of job creation in June was sufficient to please investors and keep the central bank on course to slowly begin pulling back on its major bond-buying program this fall. But the job gains were muted enough to calm worries of an abrupt exit by the Fed, a fear that has weighed on the markets lately.

The employment report, which showed the economy added 195,000 jobs, was the first since the Fed chairman, Ben S. Bernanke, said in June that policy makers were ready to begin tapering the stimulus later this year if the labor market continued to improve. The jobless rate was unchanged, at 7.6 percent.

The timing of the Fed action is critical. The central bank’s program of buying $85 billion a month in Treasury securities and mortgage-backed bonds has not only kept long-term interest rates low for borrowers, including big companies as well as individual home buyers, it has also helped prop up Wall Street.

The possibility that the Fed might move more quickly than expected to dial back the program has prompted investors to sell both stocks and bonds in the last six weeks and has raised rates on mortgages and other loans.

Buoyed by the promise of moderate economic growth and a slow but steady tapering on the part of the Fed, traders pushed the stock market higher on Friday, with major indexes gaining about 1 percent.

The 195,000 jobs added in June was significantly above the 165,000 monthly pace analysts had been expecting. And the government sharply revised upward figures for job gains in April and May, increasing the average monthly gain in the first half of 2013 to 202,000 jobs.

But the picture painted by the data hardly reflected a booming economy.

The unemployment rate, which is based on a different survey from the one that tracks job creation, remained stuck at 7.6 percent, far higher than the historical pattern for this stage of a recovery. Other measures of joblessness actually rose, with the broadest one that includes workers forced to accept part-time positions jumping to 14.3 percent, from 13.8 percent.

“Beyond the headline numbers for job growth, it gets a little more mixed,” said Jan Hatzius, chief economist at Goldman Sachs. “There is still a lot of slack in the labor market.”

Although the economy has held up better than some analysts expected in the face of tax increases and automatic cuts in federal spending this year, overall growth in economic output has also been tepid. The economy grew at an annual rate of 1.8 percent in the first quarter, short of what’s needed to quickly lower the unemployment rate.

Still, the job figures for June were enough to prompt Mr. Hatzius and other leading economists on Wall Street to predict that the Fed could announce a shift in policy in September, rather than waiting until December.

“This was a solid report and it will be seen by the Fed as fully consistent with tapering in September,” said Dean Maki, chief United States economist at Barclays.

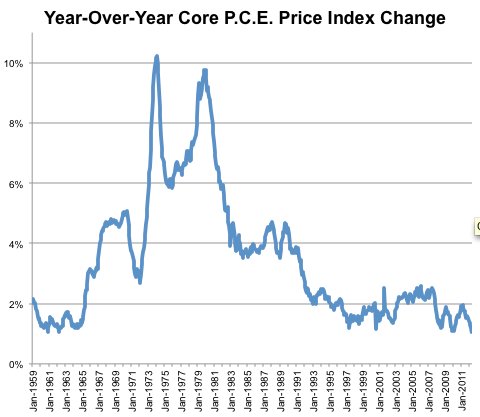

In addition, Mr. Maki noted, average hourly earnings rose 2.2 percent year-over-year, a pace that is near a high for this recovery. Before setting a firm date, Fed policy makers will be closely watching to see if the job market maintains momentum through July and August. “It’s not a done deal in September, just more likely,” Mr. Hatzius said.

That was benign enough for traders on Friday. The Standard Poor’s 500-stock index rose 16.48, or 1.02 percent, to 1,631.89, while the Dow Jones industrial average jumped 147.29, or 0.98 percent, to 15,135.84, and the Nasdaq gained 35.71, or 1.04 percent, to finish the day at 3,479.38.

In the bond market, interest rates moved higher, as investors dumped debt on anticipation of faster growth and quicker Fed action. The 10-year Treasury note fell 1 30/32, to 91 17/32, while its yield jumped to 2.74 percent, from 2.50 percent late Wednesday.

The Fed’s stance has bolstered long-term rates, but the central bank is expected to keep short-term rates low at least until 2015.

Article source: http://www.nytimes.com/2013/07/06/business/economy-adds-195000-jobs-as-unemployment-rate-remains-at-7-6.html?partner=rss&emc=rss