That is the problem Apple faces. Analysts say it must decide whether to keep catering to the high end of the phone market, reaping fat profits from relatively fewer sales, or offer something cheaper to compete with lower-cost alternatives like Samsung’s phones.

Worries about low-cost competition weighed on Apple’s stock on Monday after reports that the company had reduced orders of screens for the iPhone 5, suggesting that demand for the phone could be weaker than expected. The company’s shares dropped 3.6 percent for the day to close at $501.75; they have slid 29 percent from their high in September.

The long slump in the stock price has increased the pressure on the company to produce a solid earnings report next Wednesday, when investors will be looking closely to see how strong iPhone sales were.

The iPhone is still a top seller in the American market. But it has a tougher time competing in other markets, where consumers buy phones without a subsidy from a wireless carrier. In countries like Brazil, Germany and Spain, the iPhone 5 can cost $650.

And even the cheaper iPhones, like the 4 and 4S, are more expensive than the cheapest Android phones, said Tero Kuittinen, an independent mobile analyst and vice president of Alekstra, a company that helps people manage their cellphone bills.

“The people buying their first smartphones now are lower-income households,” Mr. Kuittinen said. “They don’t have enough money to have $650 to pay for a smartphone.”

Analysts say that in the earnings report, they will pay special attention to the average selling price of iPhones to determine whether the iPhone 5 is still the hot seller or whether cheaper models are making up a majority of sales. The trend might help determine whether Apple will eventually introduce a new lower-end iPhone.

Apple does appear to be cutting back on orders for its latest iPhone from its manufacturing partners, as Nikkei of Japan and The Wall Street Journal reported earlier. Paul Semenza, an analyst at NPD DisplaySearch, a research firm that follows the display market, said that for January, Apple had expected to order 19 million displays for the iPhone 5 but cut the order to 11 million to 14 million. Mr. Semenza said these numbers came from sources in the supply chain, the companies that make components for Apple products.

The reduction in orders for screens could be related to excess inventory, or because consumer demand for the iPhone 5 just was not as strong as Apple had predicted, Mr. Semenza said. “Certainly, demand from Apple to the display makers seems to have been corrected pretty significantly,” he said.

Natalie Kerris, an Apple spokeswoman, declined to comment.

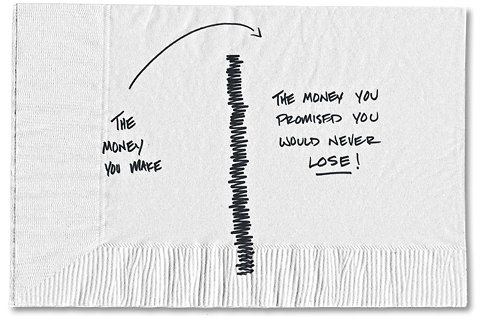

Laurence I. Balter, an analyst at Oracle Investment Research, said one reason Apple’s stock had been hurting was that analysts often overshoot with their predictions for how many devices Apple will sell each quarter. He said that might explain some of Monday’s sharp drop: “Everybody got a little too aggressive and optimistic.”

Mr. Balter said there was plenty of room left for Apple to grow and China was a particularly important market. The iPhone is available there for China Unicom, a major wireless network. But Apple has yet to strike a deal with China’s bigger cellphone carrier, China Mobile, which has a whopping 600 million subscribers — about six times as many as ATT. That is Apple’s opportunity for huge growth, Mr. Balter said.

“In China, the Apple brand on the iPhone is a status symbol,” he said. “You’re going to have the Samsung device, which is a nice phone, or you’ll show your friends you have an Apple device. It’s like wearing a pair of Levi’s versus a Costco brand.”

Mr. Balter said he thought Apple’s strategy for growth would be to go after more price-conscious consumers, because once they become customers, they are likely to keep buying other Apple products. Perhaps the key to that strategy will be a cheaper iPhone, he said.

But even if Apple were to offer a cheaper iPhone, it is unlikely it would be dirt cheap, Mr. Kuittinen said. If it chose to play more aggressively in foreign markets, Apple would more likely introduce a midprice model that is cheaper than the newest iPhone but more expensive than the cheapest phones on the market, he said. That would be similar to its approach with the iPad Mini, which is more expensive than the smaller tablets sold by Google and Amazon but much cheaper than the full-size iPad.

This article has been revised to reflect the following correction:

Correction: January 16, 2013

Because of an editing error, an earlier version of this article misstated the day that Apple is scheduled to report its quarterly earnings. It is Jan. 23, not Jan. 16.

Article source: http://www.nytimes.com/2013/01/15/technology/worry-over-sales-spurs-talk-of-cheaper-iphones.html?partner=rss&emc=rss