CATHERINE RAMPELL

Dollars to doughnuts.

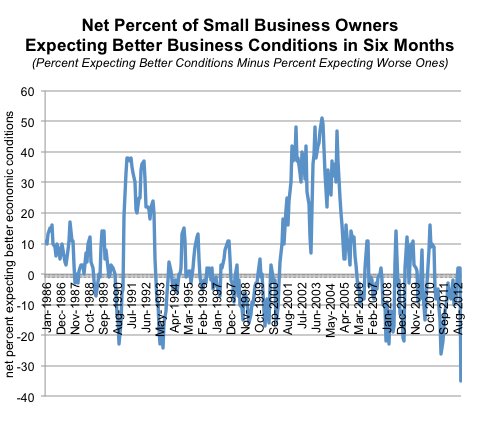

The Small Business Optimism Index is starting to look misnamed.

The index, reported monthly by the National Federation of Independent Business, had one of the steepest declines in its history in November, and is now at one of its lowest readings ever. The industry group has reported a lower index value only seven times since it began conducting monthly surveys in 1986. Businesses, it seems, are about as optimistic today as they are during the typical recession.

Hurricane Sandy did not seem to have driven the decline in optimism, either, given that the survey did not show much difference between sentiment at businesses in states hit by Sandy and those in states it spared.

The big drag on overall optimism came from small businesses’ view of the future.

In October, businesses were slightly more likely to say that they expected business conditions to improve in the next six months than they were to say that conditions would worsen. But by November, the outlook darkened substantially. The net percentage of business owners saying they expected better conditions — that is, the share saying they expect improvement minus the share saying they expect deterioration — was negative 35 percent.

Source: National Federation of Independent Business, via Haver Analytics.

Source: National Federation of Independent Business, via Haver Analytics.

That is the worst outlook since the federation began collecting this data on a monthly basis. Bill Dunkelberg, the chief economist at the National Federation of Independent Business, attributed the pessimism about the future to looming fiscal austerity measures scheduled for 2013, higher health care costs and “the endless onslaught of new regulations.”

While businesses have been gloomy for a while, consumers had been resisting warnings about the impending so-called fiscal cliff of rising taxes and spending cuts. Until recently, that is.

The latest consumer sentiment survey from the University of Michigan showed consumer sentiment nose-diving. Gallup’s Economic Confidence Index likewise slid recently, mostly because of declining expectations about the future, although the overall index was still higher than it was for most of this year.

The Conference Board’s Consumer Confidence Index reported a small increase in November, at least.

Article source: http://economix.blogs.nytimes.com/2012/12/11/small-business-optimism-plunges/?partner=rss&emc=rss