Those inquiries, which prompt sometimes delicious and humiliating leaks, very often go nowhere, lost in a thicket of appeals and denials, with not quite enough evidence to indict the key figures involved.

France is in the midst of another cycle of scandals, most of them concerning central figures in the presidency of Nicolas Sarkozy, who lost his bid for re-election a year ago to the Socialist candidate, François Hollande. Nearly every week there are new revelations about Mr. Sarkozy or his former top lieutenants, including his good friend, consigliere, former chief of staff and former interior minister, Claude Guéant, and now even Christine Lagarde, the former finance minister.

The Lagarde case, which involves a dispute over the sale of a company, is particularly interesting for the rest of the world, since she is the well-liked managing director of the International Monetary Fund. She was chosen two years ago to replace the scandal-prone Dominique Strauss-Kahn, another former French finance minister. The case is particularly interesting for the French, too. Although Ms. Lagarde served Mr. Sarkozy, both her top aide then, Stéphane Richard, now head of France Télécom (soon to be renamed Orange), and the larger-than-life character at the center of the case, Bernard Tapie, were Socialists.

While a clear indication of the intimacy among France’s elite, no matter their political allegiance, the Lagarde case has put the Hollande government in a quandary. While Mr. Tapie’s critics dismiss him as an avaricious renegade, Ms. Lagarde has kept a vital international job in French hands and Mr. Richard is supported by both his board and by the government, which owns a significant stake in the company.

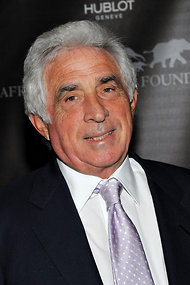

Mr. Tapie came from a modest background to become an actor, television star, racecar driver, politician, government minister, businessman and owner of one of France’s great soccer teams, Olympique de Marseille, which got him a jail term when he was found guilty of bribing opposing players. He also owned Adidas.

But in 1992, while in government, he asked the bank Crédit Lyonnais to sell Adidas, which it did for his minimum price, while concealing that it sold the company to itself. It then resold Adidas, making a profit of more than $500 million. Mr. Tapie later sued the bank, and when Mr. Sarkozy became president, Ms. Lagarde agreed to a three-judge arbitration panel to settle the long case. In July 2008 the panel awarded Mr. Tapie $528 million.

The accusation is that Mr. Sarkozy and his aides arranged the outcome, in part through the chairman of the panel, Pierre Estoup, now 86, as part of a deal with Mr. Tapie. What Mr. Tapie provided to Mr. Sarkozy in this version is not clear, but Ms. Lagarde and Mr. Richard have been interrogated in the case, and there are suggestions that Mr. Guéant was involved; he is expected to be questioned soon.

Ms. Lagarde has said that she did nothing wrong, and in testimony leaked to Le Monde suggested that Mr. Richard handled the matter and kept information from her. She is judged so far to be just a witness in the case, not a suspect, unlike Mr. Richard — who also denies wrongdoing.

But Le Monde recently published a handwritten letter from Ms. Lagarde addressed to Mr. Sarkozy, undated and possibly unsent, seized by the police when they raided her home in March over the Tapie case. The letter, leaked to embarrass Ms. Lagarde, in five points promises loyalty to Mr. Sarkozy, vows that she will do whatever he thinks needs to be done for as long as he wants to employ her, and asks for his advice, support and counsel. Written in the familiar “tu” form, it is signed, “with my immense admiration, Christine L.”

If nothing else, the letter is an indication of the sycophancy surrounding the republican imperium of the French presidency, especially under Mr. Sarkozy.

Mr. Guéant, who was widely feared as Mr. Sarkozy’s enforcer, is also being investigated over receipt of a $650,000 wire from a foreign bank. He says the money was for the sale of two paintings that experts say would not be worth nearly that much, and which he did not register.

Article source: http://www.nytimes.com/2013/06/23/world/europe/french-relish-cycle-of-scandals-featuring-sarkozy-era-officials.html?partner=rss&emc=rss