Aamir Qureshi/Agence France-Presse — Getty ImagesThe day after, local residents and the news media gathered at the hideout in Pakistan where Osama bin Laden was killed by United States forces.

Aamir Qureshi/Agence France-Presse — Getty ImagesThe day after, local residents and the news media gathered at the hideout in Pakistan where Osama bin Laden was killed by United States forces.

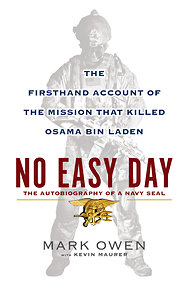

3:38 p.m. | Updated A detailed first-person account of the raid that killed Osama bin Laden, written under a pseudonym by a member of the Navy SEALs who participated in the mission and was present at bin Laden’s death, will be released next month, the publisher said on Wednesday.

The book, “No Easy Day: The Firsthand Account of the Mission That Killed Osama bin Laden,” which is scheduled to be released on Sept. 11, has been a tightly held secret at the publisher, Penguin. It promises to be one of the biggest books of the year, with the potential to affect the presidential campaign in the final weeks before the election.

The author’s name will be listed as Mark Owen by Dutton, an imprint of Penguin. For security reasons, he used a pseudonym and changed the names of other SEAL members.

A former member of SEAL Team 6, the author was a team leader in the operation that resulted in the death of Bin Laden in Abbottabad, Pakistan, on May 2, 2011. According to a description of the book provided by the publisher, the author gives a “blow-by blow narrative of the assault, beginning with the helicopter crash that could have ended Owen’s life straight through to the radio call confirming Bin Laden’s death,” and is “an essential piece of modern history.”

Penguin officials would not say to what extent the book was vetted by government agencies. Colonel Tim Nye, the chief spokesman for the military’s Special Operations Command, said he would reserve comment until he had an opportunity to read the book.

The author also recalls his childhood in Alaska, his grueling preparation to become a member of the SEALs and other previously unreported SEAL missions. He completed 13 combat deployments since the attacks of Sept. 11, 2001, and retired within the last year.

A co-writer, Kevin Maurer, is the author of four books and was embedded with Special Forces in Afghanistan six times.

The book could get caught up in the politically charged arena of the presidential campaign. That’s what happened with another planned narrative account of the raid, a film by Kathryn Bigelow and Mark Boal, “Zero Dark Thirty.” That film was originally scheduled for release in October, but was moved to December after Republicans said it would help dramatize one of the president’s signature achievements right before the election. The project also prompted complaints from some Republicans that the administration had provided improper access about the raid to the filmmakers, a charge the White House denied.

In August 2011, The New Yorker published an account of the raid that was so detailed it included information about what the pilot of a Black Hawk helicopter was thinking as the aircraft was on the verge of crashing. That article relied on interviews with officials who had debriefed members of the SEALs team, not with the individuals themselves.

Bookstores were first given a few clues about the book last month. One independent bookstore owner said in July that she was told only that Dutton had added a “big, major book” written by an anonymous author to its fall list.

Members of Dutton’s sales staff were given a detailed description of the book during a conference call with executives on Wednesday.

The publisher is expecting a major best seller, with a planned print run of 300,000 copies in hardcover, according to a person familiar with the plans.

Because the book is written under a pseudonym, the author will appear in disguise during television interviews to promote the book. At least one major network prime-time appearance has been planned, a person familiar with the plans said, and during interviews on television and radio, the author’s voice will be altered.

Thom Shanker contributed reporting from Washington.

Article source: http://mediadecoder.blogs.nytimes.com/2012/08/22/navy-seals-book-will-describe-raid-that-killed-bin-laden/?partner=rss&emc=rss