Yes, we have low inflation: The Commerce Department reported Friday that prices rose just 1.2 percent over the 12 months ending in January.

Such slow inflation is not, in and of itself, an argument for the Federal Reserve to expand its economic stimulus campaign. That depends on whether one expects inflation over the next year or two to rise closer to the 2 percent annual pace the Fed considers most healthy. As it happens, most Fed officials do.

But the January number does underscore that the Fed failed to do its job over the last two years. It underestimated the stimulus that the economy required then to prevent inflation from sagging below 2 percent now.

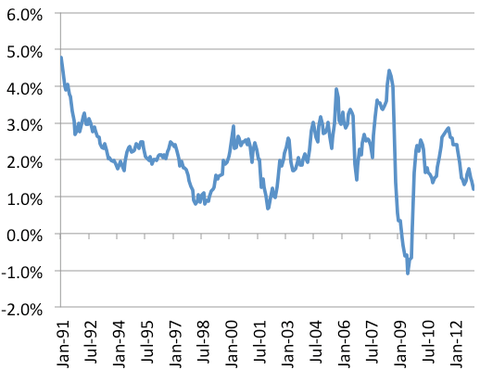

Indeed, annual price inflation has been less than 2 percent in four of the last five years, according to the Fed’s preferred measure, the personal consumption expenditures index published by the Bureau of Economic Analysis. The chart below shows 12-month inflation measure for personal consumption expenditures (known as P.C.E. inflation) month by month since 2000.

Source: Bureau of Economic Analysis Inflation rate based on personal consumption expenditures.

Source: Bureau of Economic Analysis Inflation rate based on personal consumption expenditures.

As Janet Yellen, the Fed’s vice chairwoman, said last April, “In effect there has been a significant shortfall in the overall amount of monetary policy stimulus since early 2009,” because the central bank can’t push short-term interest rates below zero, and its other measures, like asset purchases, haven’t filled the gap.

Article source: http://economix.blogs.nytimes.com/2013/03/01/not-enough-inflation/?partner=rss&emc=rss