Casey B. Mulligan is an economics professor at the University of Chicago. He is the author of “The Redistribution Recession: How Labor Market Distortions Contracted the Economy.”

Although wealthy people are a small fraction of the population, their behavior is of great practical interest to Treasury officials.

Today’s Economist

Perspectives from expert contributors.

Every year, the United States Treasury receives extraordinary amounts of personal income tax revenue in April as individuals file their returns and reconcile the taxes they owe with the taxes that were withheld from their paychecks during the previous calendar year. Most people do not owe much, if anything, when they file their return but a small group of taxpayers has large balances to settle.

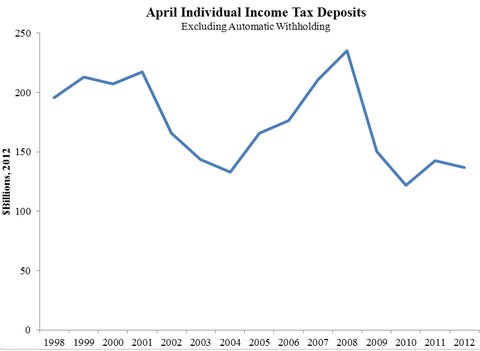

The chart below shows the inflation-adjusted amount of individual income tax receipts by the Treasury in April of each year since 1998, as reported by in the Daily Treasury Statement. The amount has fluctuated wildly, from a low of $122 billion to a high of $235 billion. The standard deviation of these April receipts is $36 billion.

United States Treasury

United States Treasury

The general state of the economy in the calendar year helps to predict the amount the Treasury receives in following April. At the same time, additional fluctuations in April receipts derive from the situations and behaviors of a small segment of the population not well represented in the unemployment rate and other measures of the business cycle: the wealthy.

First of all, taxes are withheld less often from asset income like dividends and capital gains than they are withheld from wages. The wealthy receive a larger share of their income from assets than from wages, not to mention that by definition the wealthy have more of both types of income. Second, much of the population does not owe any income tax – let alone owe extra in April – and the wealthy pay a disproportionate share of income taxes.

The wealthy have become an even more important driver of tax revenues in recent history, as an increasing share of the nation’s income has accrued to them. Thomas Piketty and Emmanuel Saez have compiled decades of data for the United States (and other countries). They find, for example, that the very wealthiest of America’s households — the top one-tenth of 1 percent — recently received about one-thirteenth of the nation’s income, while they received only one-fiftieth in the 1960s and 1970s.

The wealthy are sometimes idolized and other times envied, and for these reasons alone their behavior is of interest. But Treasury officials have another reason to stay abreast of the wealthy: their activities are an important determinant of the amount of revenue received by the Treasury, and when it is received.

If you have special insights into how the wealthy behave, consider applying for a job at the Treasury.

Article source: http://economix.blogs.nytimes.com/2013/04/17/the-wealthy-keep-the-tax-man-guessing/?partner=rss&emc=rss